Mphasis Limited (NSE:MPHASIS) Shares Slammed 25% But Getting In Cheap Might Be Difficult Regardless

The Mphasis Limited (NSE:MPHASIS) share price has fared very poorly over the last month, falling by a substantial 25%. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 14% in that time.

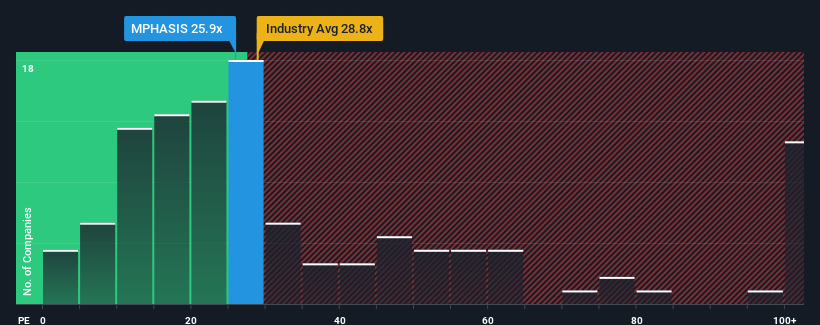

Even after such a large drop in price, there still wouldn't be many who think Mphasis' price-to-earnings (or "P/E") ratio of 25.9x is worth a mention when the median P/E in India is similar at about 25x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Mphasis could be doing better as it's been growing earnings less than most other companies lately. It might be that many expect the uninspiring earnings performance to strengthen positively, which has kept the P/E from falling. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

View our latest analysis for Mphasis

Is There Some Growth For Mphasis?

The only time you'd be comfortable seeing a P/E like Mphasis' is when the company's growth is tracking the market closely.

Taking a look back first, we see that the company managed to grow earnings per share by a handy 4.9% last year. The latest three year period has also seen a 20% overall rise in EPS, aided somewhat by its short-term performance. Therefore, it's fair to say the earnings growth recently has been respectable for the company.

Turning to the outlook, the next three years should generate growth of 17% each year as estimated by the analysts watching the company. Meanwhile, the rest of the market is forecast to expand by 19% per year, which is not materially different.

With this information, we can see why Mphasis is trading at a fairly similar P/E to the market. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

What We Can Learn From Mphasis' P/E?

Mphasis' plummeting stock price has brought its P/E right back to the rest of the market. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Mphasis maintains its moderate P/E off the back of its forecast growth being in line with the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings won't throw up any surprises. Unless these conditions change, they will continue to support the share price at these levels.

Before you settle on your opinion, we've discovered 2 warning signs for Mphasis that you should be aware of.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:MPHASIS

Mphasis

Operates as an information technology solutions provider that specializes in cloud and cognitive services in the United States, India, Europe, the Middle East, Africa, and internationally.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026