Intense Technologies (NSE:INTENTECH) Has Announced That It Will Be Increasing Its Dividend To ₹1.00

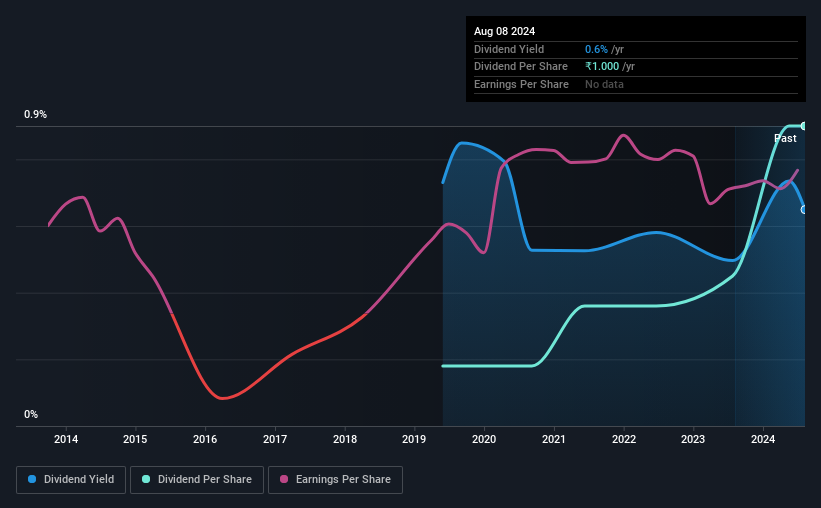

Intense Technologies Limited (NSE:INTENTECH) has announced that it will be increasing its dividend from last year's comparable payment on the 30th of October to ₹1.00. This takes the annual payment to 0.6% of the current stock price, which unfortunately is below what the industry is paying.

View our latest analysis for Intense Technologies

Intense Technologies' Payment Has Solid Earnings Coverage

The dividend yield is a little bit low, but sustainability of the payments is also an important part of evaluating an income stock. However, prior to this announcement, Intense Technologies' dividend was comfortably covered by both cash flow and earnings. This means that most of what the business earns is being used to help it grow.

Over the next year, EPS could expand by 9.9% if recent trends continue. Assuming the dividend continues along recent trends, we think the payout ratio could be 16% by next year, which is in a pretty sustainable range.

Intense Technologies Doesn't Have A Long Payment History

The dividend's track record has been pretty solid, but with only 5 years of history we want to see a few more years of history before making any solid conclusions. The dividend has gone from an annual total of ₹0.20 in 2019 to the most recent total annual payment of ₹1.00. This means that it has been growing its distributions at 38% per annum over that time. Intense Technologies has been growing its dividend quite rapidly, which is exciting. However, the short payment history makes us question whether this performance will persist across a full market cycle.

We Could See Intense Technologies' Dividend Growing

Some investors will be chomping at the bit to buy some of the company's stock based on its dividend history. Intense Technologies has impressed us by growing EPS at 9.9% per year over the past five years. With a decent amount of growth and a low payout ratio, we think this bodes well for Intense Technologies' prospects of growing its dividend payments in the future.

Intense Technologies Looks Like A Great Dividend Stock

Overall, we think this could be an attractive income stock, and it is only getting better by paying a higher dividend this year. The company is easily earning enough to cover its dividend payments and it is great to see that these earnings are being translated into cash flow. All of these factors considered, we think this has solid potential as a dividend stock.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. However, there are other things to consider for investors when analysing stock performance. Case in point: We've spotted 3 warning signs for Intense Technologies (of which 1 is potentially serious!) you should know about. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:INTENTECH

Intense Technologies

Provides enterprise platform and IP-enabled service organization services in India.

Flawless balance sheet with slight risk.

Market Insights

Weekly Picks

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

EU#4 - Turning Heritage into the World’s Strongest Luxury Empire

The "Easy Money" Is Gone: Why Alphabet Is Now a "Show Me" Story

Recently Updated Narratives

Great dividend but share numbers have increased 100% in last 12 months!!

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion