How Does Ducon Infratechnolgies's (NSE:DUCON) P/E Compare To Its Industry, After The Share Price Drop?

To the annoyance of some shareholders, Ducon Infratechnolgies (NSE:DUCON) shares are down a considerable 31% in the last month. Given the 74% drop over the last year, some shareholders might be worried that they have become bagholders. What is a bagholder? It is a shareholder who has suffered a bad loss, but continues to hold indefinitely, without questioning their reasons for holding, even as the losses grow greater.

Assuming nothing else has changed, a lower share price makes a stock more attractive to potential buyers. While the market sentiment towards a stock is very changeable, in the long run, the share price will tend to move in the same direction as earnings per share. The implication here is that long term investors have an opportunity when expectations of a company are too low. Perhaps the simplest way to get a read on investors' expectations of a business is to look at its Price to Earnings Ratio (PE Ratio). A high P/E implies that investors have high expectations of what a company can achieve compared to a company with a low P/E ratio.

View our latest analysis for Ducon Infratechnolgies

How Does Ducon Infratechnolgies's P/E Ratio Compare To Its Peers?

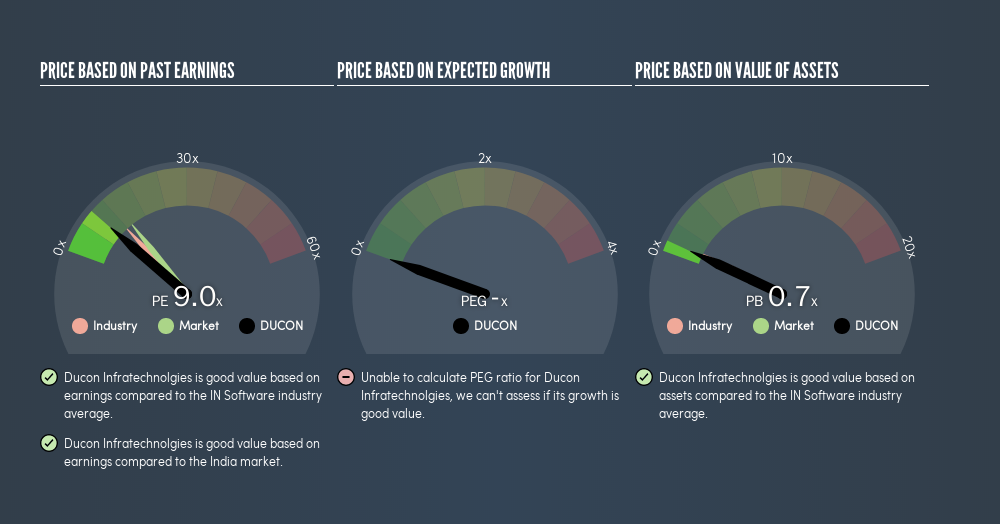

We can tell from its P/E ratio of 9 that sentiment around Ducon Infratechnolgies isn't particularly high. If you look at the image below, you can see Ducon Infratechnolgies has a lower P/E than the average (11.7) in the software industry classification.

This suggests that market participants think Ducon Infratechnolgies will underperform other companies in its industry.

How Growth Rates Impact P/E Ratios

P/E ratios primarily reflect market expectations around earnings growth rates. If earnings are growing quickly, then the 'E' in the equation will increase faster than it would otherwise. And in that case, the P/E ratio itself will drop rather quickly. So while a stock may look expensive based on past earnings, it could be cheap based on future earnings.

Ducon Infratechnolgies's earnings made like a rocket, taking off 103% last year. The cherry on top is that the five year growth rate was an impressive 120% per year. So I'd be surprised if the P/E ratio was not above average.

A Limitation: P/E Ratios Ignore Debt and Cash In The Bank

It's important to note that the P/E ratio considers the market capitalization, not the enterprise value. Thus, the metric does not reflect cash or debt held by the company. The exact same company would hypothetically deserve a higher P/E ratio if it had a strong balance sheet, than if it had a weak one with lots of debt, because a cashed up company can spend on growth.

Such spending might be good or bad, overall, but the key point here is that you need to look at debt to understand the P/E ratio in context.

So What Does Ducon Infratechnolgies's Balance Sheet Tell Us?

Net debt totals a substantial 155% of Ducon Infratechnolgies's market cap. This level of debt justifies a relatively low P/E, so remain cognizant of the debt, if you're comparing it to other stocks.

The Bottom Line On Ducon Infratechnolgies's P/E Ratio

Ducon Infratechnolgies's P/E is 9 which is below average (13.6) in the IN market. While the EPS growth last year was strong, the significant debt levels reduce the number of options available to management. If the company can continue to grow earnings, then the current P/E may be unjustifiably low. Given Ducon Infratechnolgies's P/E ratio has declined from 13.1 to 9 in the last month, we know for sure that the market is more worried about the business today, than it was back then. For those who prefer invest in growth, this stock apparently offers limited promise, but the deep value investors may find the pessimism around this stock enticing.

Investors should be looking to buy stocks that the market is wrong about. If the reality for a company is not as bad as the P/E ratio indicates, then the share price should increase as the market realizes this. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

You might be able to find a better buy than Ducon Infratechnolgies. If you want a selection of possible winners, check out this free list of interesting companies that trade on a P/E below 20 (but have proven they can grow earnings).

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NSEI:DUCON

Ducon Infratechnologies

A fossil fuel/clean coal technology company, provides solutions in the fields of flue gas desulphurization (FGD) systems and material handling systems in India.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)