Did Ducon Infratechnolgies Limited (NSE:DUCON) Use Debt To Deliver Its ROE Of 8.1%?

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Many investors are still learning about the various metrics that can be useful when analysing a stock. This article is for those who would like to learn about Return On Equity (ROE). To keep the lesson grounded in practicality, we'll use ROE to better understand Ducon Infratechnolgies Limited (NSE:DUCON).

Ducon Infratechnolgies has a ROE of 8.1%, based on the last twelve months. Another way to think of that is that for every ₹1 worth of equity in the company, it was able to earn ₹0.081.

See our latest analysis for Ducon Infratechnolgies

How Do I Calculate Return On Equity?

The formula for return on equity is:

Return on Equity = Net Profit ÷ Shareholders' Equity

Or for Ducon Infratechnolgies:

8.1% = ₹63m ÷ ₹786m (Based on the trailing twelve months to March 2019.)

Most readers would understand what net profit is, but it’s worth explaining the concept of shareholders’ equity. It is the capital paid in by shareholders, plus any retained earnings. The easiest way to calculate shareholders' equity is to subtract the company's total liabilities from the total assets.

What Does Return On Equity Mean?

Return on Equity measures a company's profitability against the profit it has kept for the business (plus any capital injections). The 'return' is the profit over the last twelve months. A higher profit will lead to a higher ROE. So, all else being equal, a high ROE is better than a low one. Clearly, then, one can use ROE to compare different companies.

Does Ducon Infratechnolgies Have A Good Return On Equity?

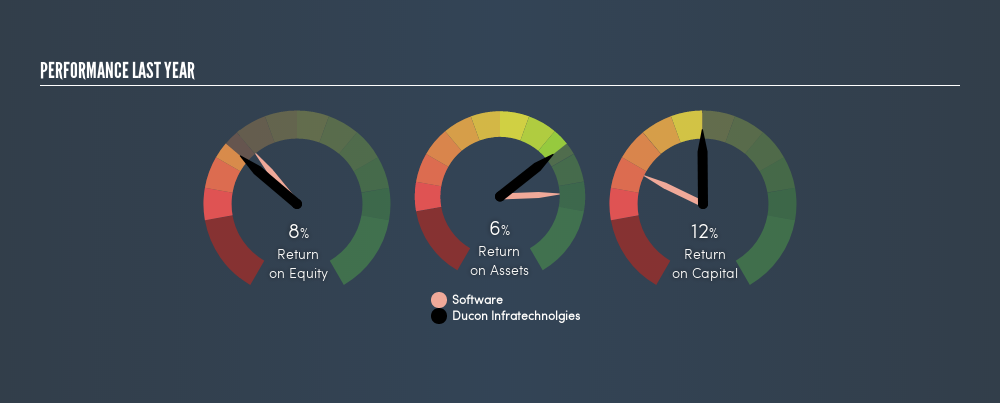

Arguably the easiest way to assess company's ROE is to compare it with the average in its industry. Importantly, this is far from a perfect measure, because companies differ significantly within the same industry classification. If you look at the image below, you can see Ducon Infratechnolgies has a similar ROE to the average in the Software industry classification (9.7%).

That's neither particularly good, nor bad. ROE can give us a view about company quality, but many investors also look to other factors, such as whether there are insiders buying shares. I will like Ducon Infratechnolgies better if I see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Why You Should Consider Debt When Looking At ROE

Most companies need money -- from somewhere -- to grow their profits. The cash for investment can come from prior year profits (retained earnings), issuing new shares, or borrowing. In the first two cases, the ROE will capture this use of capital to grow. In the latter case, the debt required for growth will boost returns, but will not impact the shareholders' equity. Thus the use of debt can improve ROE, albeit along with extra risk in the case of stormy weather, metaphorically speaking.

Combining Ducon Infratechnolgies's Debt And Its 8.1% Return On Equity

It's worth noting the significant use of debt by Ducon Infratechnolgies, leading to its debt to equity ratio of 1.39. With a fairly low ROE, and significant use of debt, it's hard to get excited about this business at the moment. Debt increases risk and reduces options for the company in the future, so you generally want to see some good returns from using it.

In Summary

Return on equity is one way we can compare the business quality of different companies. Companies that can achieve high returns on equity without too much debt are generally of good quality. If two companies have around the same level of debt to equity, and one has a higher ROE, I'd generally prefer the one with higher ROE.

Having said that, while ROE is a useful indicator of business quality, you'll have to look at a whole range of factors to determine the right price to buy a stock. Profit growth rates, versus the expectations reflected in the price of the stock, are a particularly important to consider. Check the past profit growth by Ducon Infratechnolgies by looking at this visualization of past earnings, revenue and cash flow.

But note: Ducon Infratechnolgies may not be the best stock to buy. So take a peek at this free list of interesting companies with high ROE and low debt.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NSEI:DUCON

Ducon Infratechnologies

A fossil fuel/clean coal technology company, provides solutions in the fields of flue gas desulphurization (FGD) systems and material handling systems in India.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion