Does DiGiSPICE Technologies (NSE:DIGISPICE) Have A Healthy Balance Sheet?

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. Importantly, DiGiSPICE Technologies Limited (NSE:DIGISPICE) does carry debt. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

View our latest analysis for DiGiSPICE Technologies

How Much Debt Does DiGiSPICE Technologies Carry?

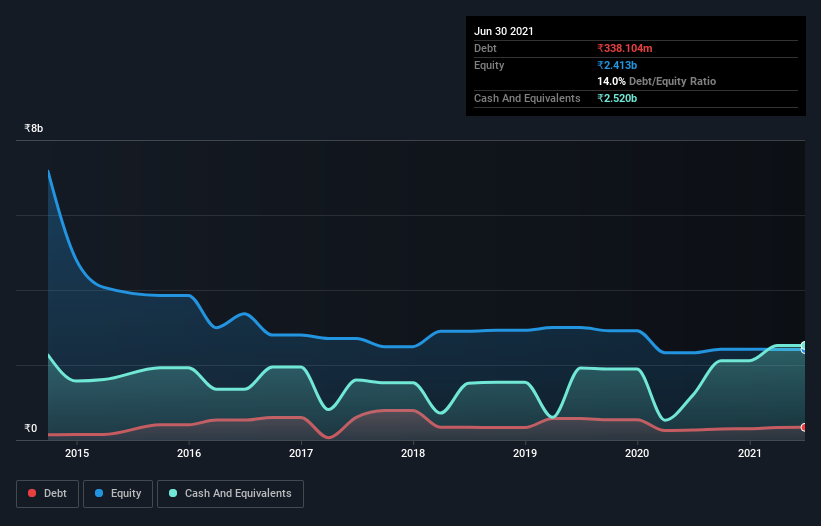

The image below, which you can click on for greater detail, shows that at March 2021 DiGiSPICE Technologies had debt of ₹328.0m, up from ₹264.0m in one year. But on the other hand it also has ₹2.52b in cash, leading to a ₹2.19b net cash position.

How Strong Is DiGiSPICE Technologies' Balance Sheet?

According to the last reported balance sheet, DiGiSPICE Technologies had liabilities of ₹2.81b due within 12 months, and liabilities of ₹90.2m due beyond 12 months. Offsetting these obligations, it had cash of ₹2.52b as well as receivables valued at ₹412.9m due within 12 months. So these liquid assets roughly match the total liabilities.

This state of affairs indicates that DiGiSPICE Technologies' balance sheet looks quite solid, as its total liabilities are just about equal to its liquid assets. So it's very unlikely that the ₹15.1b company is short on cash, but still worth keeping an eye on the balance sheet. Succinctly put, DiGiSPICE Technologies boasts net cash, so it's fair to say it does not have a heavy debt load! When analysing debt levels, the balance sheet is the obvious place to start. But it is DiGiSPICE Technologies's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

In the last year DiGiSPICE Technologies wasn't profitable at an EBIT level, but managed to grow its revenue by 65%, to ₹7.7b. With any luck the company will be able to grow its way to profitability.

So How Risky Is DiGiSPICE Technologies?

Although DiGiSPICE Technologies had an earnings before interest and tax (EBIT) loss over the last twelve months, it made a statutory profit of ₹77m. So taking that on face value, and considering the cash, we don't think its very risky in the near term. Keeping in mind its 65% revenue growth over the last year, we think there's a decent chance the company is on track. There's no doubt fast top line growth can cure all manner of ills, for a stock. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. For instance, we've identified 1 warning sign for DiGiSPICE Technologies that you should be aware of.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

If you decide to trade DiGiSPICE Technologies, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:DIGISPICE

DiGiSPICE Technologies

Engages in the provision of tech-enabled local payments network services in India and internationally.

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

Looking to be second time lucky with a game-changing new product

PlaySide Studios: Market Is Sleeping on a Potential 10M+ Unit Breakout Year, FY26 Could Be the Rerate of the Decade

Inotiv NAMs Test Center

This isn’t speculation — this is confirmation.A Schedule 13G was filed, not a 13D, meaning this is passive institutional capital, not acti

Recently Updated Narratives

Valuation Analysis of Palantir Technologies: Growth Assumptions and Market Expectations

Coca-Cola’s Enduring Moat in a Health-Conscious World: Steady Compounder Poised for 5-10% Annual Returns Through Emerging Market Dominance

Asset-Light but Valuation-Heavy: A Fundamental Breakdown of Marriott ($MAR)

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks