DiGiSPICE Technologies (NSE:DIGISPICE) stock performs better than its underlying earnings growth over last five years

It hasn't been the best quarter for DiGiSPICE Technologies Limited (NSE:DIGISPICE) shareholders, since the share price has fallen 16% in that time. But that scarcely detracts from the really solid long term returns generated by the company over five years. Indeed, the share price is up an impressive 260% in that time. So while it's never fun to see a share price fall, it's important to look at a longer time horizon. Ultimately business performance will determine whether the stock price continues the positive long term trend. Unfortunately not all shareholders will have held it for the long term, so spare a thought for those caught in the 26% decline over the last twelve months.

Since it's been a strong week for DiGiSPICE Technologies shareholders, let's have a look at trend of the longer term fundamentals.

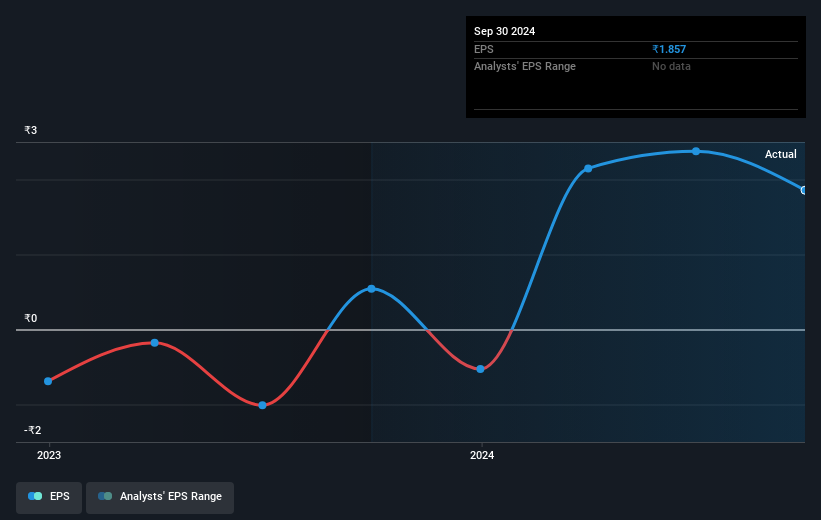

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During the five years of share price growth, DiGiSPICE Technologies moved from a loss to profitability. That kind of transition can be an inflection point that justifies a strong share price gain, just as we have seen here.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

Dive deeper into DiGiSPICE Technologies' key metrics by checking this interactive graph of DiGiSPICE Technologies's earnings, revenue and cash flow.

A Different Perspective

DiGiSPICE Technologies shareholders are down 26% for the year, but the market itself is up 5.2%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. On the bright side, long term shareholders have made money, with a gain of 29% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. It's always interesting to track share price performance over the longer term. But to understand DiGiSPICE Technologies better, we need to consider many other factors. Consider risks, for instance. Every company has them, and we've spotted 3 warning signs for DiGiSPICE Technologies you should know about.

Of course DiGiSPICE Technologies may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Indian exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:DIGISPICE

DiGiSPICE Technologies

Engages in the provision of tech-enabled local payments network services in India and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

The "Sleeping Giant" Stumbles, Then Wakes Up

Swiped Left by Wall Street: The BMBL Rebound Trade

Duolingo (DUOL): Why A 20% Drop Might Be The Entry Point We've Been Waiting For

Recently Updated Narratives

In my view, the share still looks attractive. The upside is not dramatic, but neither is the downside at current levels.

QDay is coming - 01 Quantum hold the key

Alexandria Real Estate Equities Is Going to Transform With a 27.2% Future Pe Ratio

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).