Not Many Are Piling Into Dev Information Technology Limited (NSE:DEVIT) Stock Yet As It Plummets 30%

Dev Information Technology Limited (NSE:DEVIT) shareholders that were waiting for something to happen have been dealt a blow with a 30% share price drop in the last month. Longer-term, the stock has been solid despite a difficult 30 days, gaining 14% in the last year.

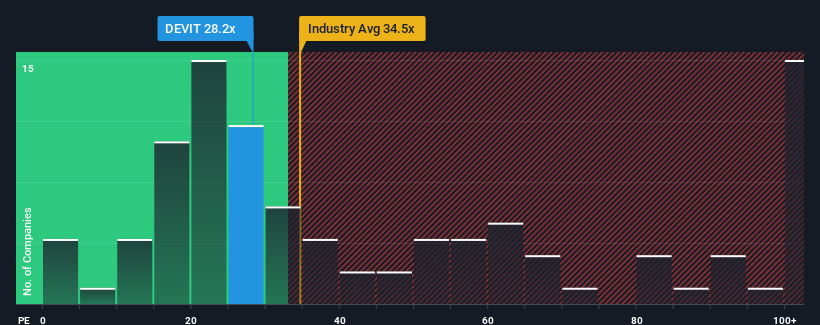

Although its price has dipped substantially, it's still not a stretch to say that Dev Information Technology's price-to-earnings (or "P/E") ratio of 28.2x right now seems quite "middle-of-the-road" compared to the market in India, where the median P/E ratio is around 30x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

With earnings growth that's exceedingly strong of late, Dev Information Technology has been doing very well. The P/E is probably moderate because investors think this strong earnings growth might not be enough to outperform the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

View our latest analysis for Dev Information Technology

Is There Some Growth For Dev Information Technology?

In order to justify its P/E ratio, Dev Information Technology would need to produce growth that's similar to the market.

If we review the last year of earnings growth, the company posted a terrific increase of 42%. The strong recent performance means it was also able to grow EPS by 472% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Comparing that to the market, which is only predicted to deliver 24% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised earnings results.

With this information, we find it interesting that Dev Information Technology is trading at a fairly similar P/E to the market. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

What We Can Learn From Dev Information Technology's P/E?

Dev Information Technology's plummeting stock price has brought its P/E right back to the rest of the market. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of Dev Information Technology revealed its three-year earnings trends aren't contributing to its P/E as much as we would have predicted, given they look better than current market expectations. When we see strong earnings with faster-than-market growth, we assume potential risks are what might be placing pressure on the P/E ratio. At least the risk of a price drop looks to be subdued if recent medium-term earnings trends continue, but investors seem to think future earnings could see some volatility.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Dev Information Technology that you should be aware of.

You might be able to find a better investment than Dev Information Technology. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:DEVIT

Dev Information Technology

Provides information technology enabled services in India, Europe, and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

An Undervalued 3.3Moz Gold Project in Canada

SoFi Technologies: The Apex Aggregator and the Infrastructure of the Modern Financial System

CSL: The Dip Is the Opportunity

DHT Holdings, inc: Strait of Hormuz Risk Amidst US-Israel vs Iran Tensions Spikes VLCC Rates.

Recently Updated Narratives

Strategic pivot in maximizing corporate value

Buy-out proposal for BARK Inc., at $1.10 has be confirmed by the acquisition group

Paladin Energy: Betting on the Nuclear Renaissance

Popular Narratives

Nu holdings will continue to disrupt the South American banking market

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks