It's Unlikely That Dev Information Technology Limited's (NSE:DEVIT) CEO Will See A Huge Pay Rise This Year

Key Insights

- Dev Information Technology's Annual General Meeting to take place on 30th of September

- Salary of ₹5.79m is part of CEO Jaimin Shah's total remuneration

- The total compensation is 203% higher than the average for the industry

- Over the past three years, Dev Information Technology's EPS grew by 36% and over the past three years, the total shareholder return was 426%

CEO Jaimin Shah has done a decent job of delivering relatively good performance at Dev Information Technology Limited (NSE:DEVIT) recently. In light of this performance, CEO compensation will probably not be the main focus for shareholders as they go into the AGM on 30th of September. However, some shareholders may still be hesitant of being overly generous with CEO compensation.

See our latest analysis for Dev Information Technology

Comparing Dev Information Technology Limited's CEO Compensation With The Industry

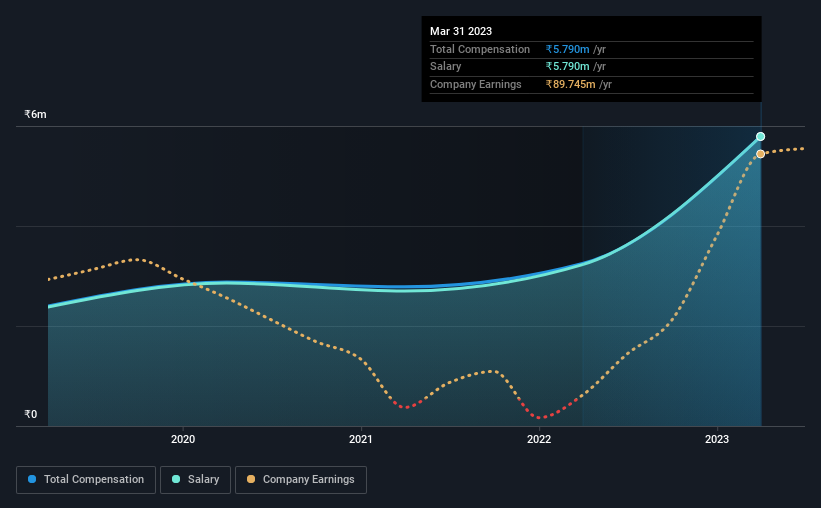

At the time of writing, our data shows that Dev Information Technology Limited has a market capitalization of ₹4.1b, and reported total annual CEO compensation of ₹5.8m for the year to March 2023. That's a notable increase of 78% on last year. It is worth noting that the CEO compensation consists entirely of the salary, worth ₹5.8m.

In comparison with other companies in the Indian IT industry with market capitalizations under ₹17b, the reported median total CEO compensation was ₹1.9m. This suggests that Jaimin Shah is paid more than the median for the industry. Furthermore, Jaimin Shah directly owns ₹965m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | ₹5.8m | ₹3.2m | 100% |

| Other | - | ₹22k | - |

| Total Compensation | ₹5.8m | ₹3.3m | 100% |

On an industry level, roughly 99% of total compensation represents salary and 1% is other remuneration. On a company level, Dev Information Technology prefers to reward its CEO through a salary, opting not to pay Jaimin Shah through non-salary benefits. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

Dev Information Technology Limited's Growth

Dev Information Technology Limited's earnings per share (EPS) grew 36% per year over the last three years. In the last year, its revenue is up 53%.

This demonstrates that the company has been improving recently and is good news for the shareholders. The combination of strong revenue growth with medium-term EPS improvement certainly points to the kind of growth we like to see. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Dev Information Technology Limited Been A Good Investment?

Boasting a total shareholder return of 426% over three years, Dev Information Technology Limited has done well by shareholders. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

To Conclude...

Dev Information Technology pays CEO compensation exclusively through a salary, with non-salary compensation completely ignored. Seeing that the company has put up a decent performance, only a few shareholders, if any at all, might have questions about the CEO pay in the upcoming AGM. Still, not all shareholders might be in favor of a pay raise to the CEO, seeing that they are already being paid higher than the industry.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. That's why we did some digging and identified 3 warning signs for Dev Information Technology that you should be aware of before investing.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:DEVIT

Dev Information Technology

Provides information technology enabled services in India, Europe, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

The Future of Social Sharing Is Private and People Are Ready

EU#3 - From Philips Management Buyout to Europe’s Biggest Company

Booking Holdings: Why Ground-Level Travel Trends Still Favor the Platform Giants

A fully integrated LNG business seems to be ignored by the market.

Recently Updated Narratives

Sustained Silver at ~US$100/oz Drives Explosive Leverage and Re-Rating for PAAS

LVMH - A Fundamental and Historical Valuation

Bad management practices jeopardize long-term future of VRSN

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

<b>Reported:</b> Revenue growth: 2024 → 2025 sharp increase of approx. 165%. Assuming moderate annual growth of 40%, a fair value in three years would be approx. $170. Given the customer base and the story, this should be possible. I find the most valuable “property” particularly interesting, as it solves the electricity problem.