Coforge Third Quarter 2025 Earnings: Revenues Beat Expectations, EPS Lags

Coforge (NSE:COFORGE) Third Quarter 2025 Results

Key Financial Results

- Revenue: ₹33.8b (up 45% from 3Q 2024).

- Net income: ₹2.16b (down 9.5% from 3Q 2024).

- Profit margin: 6.4% (down from 10% in 3Q 2024). The decrease in margin was driven by higher expenses.

- EPS: ₹32.26 (down from ₹38.63 in 3Q 2024).

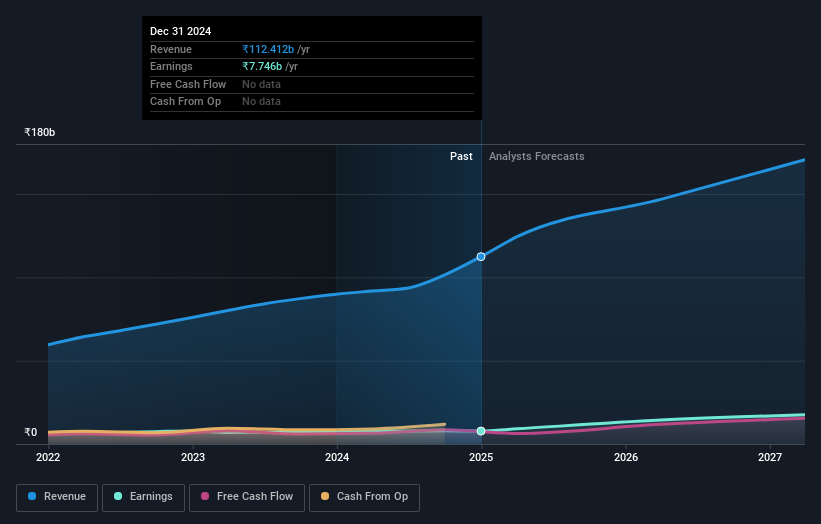

All figures shown in the chart above are for the trailing 12 month (TTM) period

Coforge Revenues Beat Expectations, EPS Falls Short

Revenue exceeded analyst estimates by 3.5%. Earnings per share (EPS) missed analyst estimates by 17%.

Looking ahead, revenue is forecast to grow 17% p.a. on average during the next 3 years, compared to a 8.0% growth forecast for the IT industry in India.

Performance of the Indian IT industry.

The company's shares are up 5.3% from a week ago.

Risk Analysis

It's still necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Coforge, and understanding it should be part of your investment process.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:COFORGE

Coforge

Provides information technology (IT) and IT-enabled services in India, the Americas, Europe, the Middle East and Africa, India, and the Asia Pacific.

High growth potential with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion