- India

- /

- Professional Services

- /

- NSEI:CADSYS

Investors Who Bought Cadsys (India) (NSE:CADSYS) Shares A Year Ago Are Now Down 23%

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

The simplest way to benefit from a rising market is to buy an index fund. Active investors aim to buy stocks that vastly outperform the market - but in the process, they risk under-performance. That downside risk was realized by Cadsys (India) Limited (NSE:CADSYS) shareholders over the last year, as the share price declined 23%. That contrasts poorly with the market return of 3.8%. Cadsys (India) hasn't been listed for long, so although we're wary of recent listings that perform poorly, it may still prove itself with time. On top of that, the share price has dropped a further 17% in a month.

See our latest analysis for Cadsys (India)

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Even though the Cadsys (India) share price is down over the year, its EPS actually improved. It could be that the share price was previously over-hyped. It's surprising to see the share price fall so much, despite the improved EPS. But we might find some different metrics explain the share price movements better.

Cadsys (India)'s revenue is actually up 16% over the last year. Since the fundamental metrics don't readily explain the share price drop, there might be an opportunity if the market has overreacted.

Take a more thorough look at Cadsys (India)'s financial health with this free report on its balance sheet.

A Different Perspective

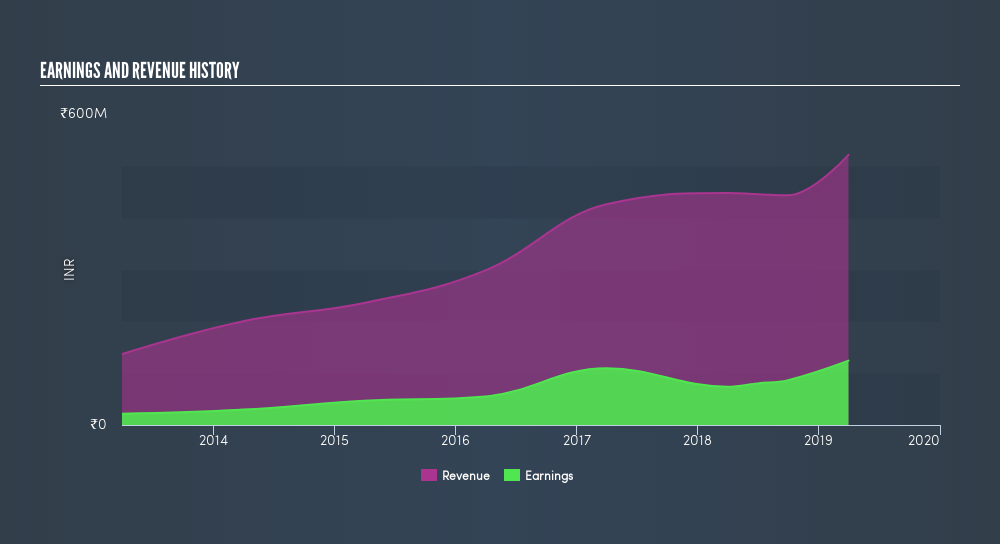

While Cadsys (India) shareholders are down 22% for the year (even including dividends), the market itself is up 3.8%. While the aim is to do better than that, it's worth recalling that even great long-term investments sometimes underperform for a year or more. Putting aside the last twelve months, it's good to see the share price has rebounded by 2.1%, in the last ninety days. This could just be a bounce because the selling was too aggressive, but fingers crossed it's the start of a new trend. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

Of course Cadsys (India) may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NSEI:CADSYS

Cadsys (India)

A knowledge process outsourcing company, provides knowledge solutions in India and internationally.

Low and slightly overvalued.

Similar Companies

Market Insights

Community Narratives