While not a mind-blowing move, it is good to see that the Airan Limited (NSE:AIRAN) share price has gained 22% in the last three months. But that doesn't change the fact that the returns over the last year have been disappointing. During that time the share price has sank like a stone, descending 55%. It's not that amazing to see a bounce after a drop like that. Arguably, the fall was overdone.

See our latest analysis for Airan

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During the unfortunate twelve months during which the Airan share price fell, it actually saw its earnings per share (EPS) improve by 12%. It's quite possible that growth expectations may have been unreasonable in the past.

It's surprising to see the share price fall so much, despite the improved EPS. So it's easy to justify a look at some other metrics.

Airan's revenue is actually up 20% over the last year. Since we can't easily explain the share price movement based on these metrics, it might be worth considering how market sentiment has changed towards the stock.

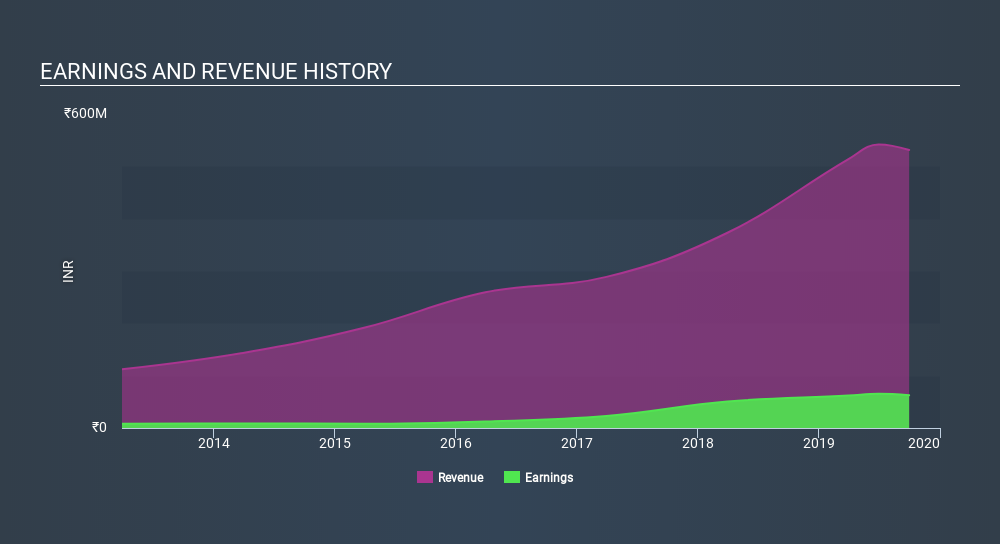

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. This free interactive report on Airan's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

While Airan shareholders are down 55% for the year, the market itself is up 11%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. It's great to see a nice little 22% rebound in the last three months. Let's just hope this isn't the widely-feared 'dead cat bounce' (which would indicate further declines to come). It's always interesting to track share price performance over the longer term. But to understand Airan better, we need to consider many other factors. Consider risks, for instance. Every company has them, and we've spotted 2 warning signs for Airan you should know about.

But note: Airan may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NSEI:AIRAN

Airan

Provides information technology (IT) and IT-enabled services in India.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives