Here's Why We Think Allied Digital Services (NSE:ADSL) Is Well Worth Watching

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like Allied Digital Services (NSE:ADSL). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

See our latest analysis for Allied Digital Services

How Fast Is Allied Digital Services Growing Its Earnings Per Share?

Over the last three years, Allied Digital Services has grown earnings per share (EPS) like young bamboo after rain; fast, and from a low base. So I don't think the percent growth rate is particularly meaningful. As a result, I'll zoom in on growth over the last year, instead. Like a firecracker arcing through the night sky, Allied Digital Services's EPS shot from ₹3.61 to ₹8.88, over the last year. You don't see 146% year-on-year growth like that, very often.

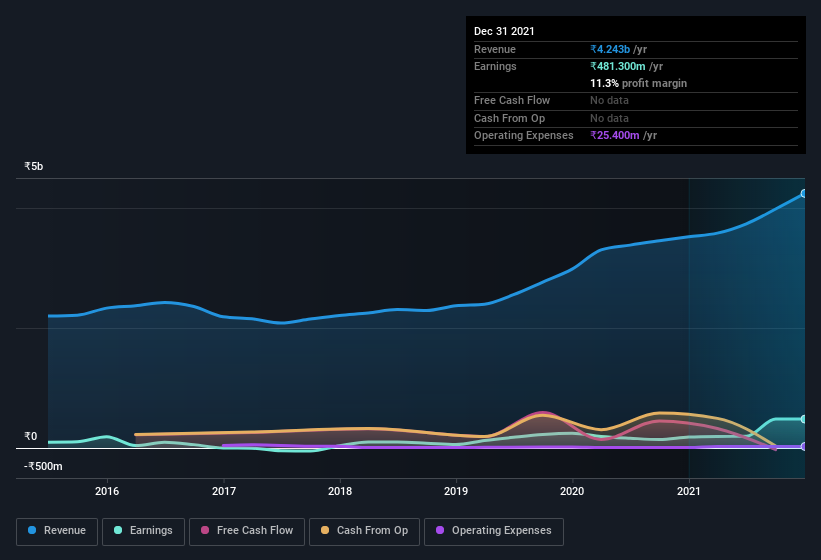

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Allied Digital Services shareholders can take confidence from the fact that EBIT margins are up from 5.8% to 8.0%, and revenue is growing. Ticking those two boxes is a good sign of growth, in my book.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

Allied Digital Services isn't a huge company, given its market capitalization of ₹7.2b. That makes it extra important to check on its balance sheet strength.

Are Allied Digital Services Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

We haven't seen any insiders selling Allied Digital Services shares, in the last year. So it's definitely nice that Rohan Shah bought ₹1.1m worth of shares at an average price of around ₹63.36.

On top of the insider buying, we can also see that Allied Digital Services insiders own a large chunk of the company. Indeed, with a collective holding of 60%, company insiders are in control and have plenty of capital behind the venture. To me this is a good sign because it suggests they will be incentivised to build value for shareholders over the long term. With that sort of holding, insiders have about ₹4.3b riding on the stock, at current prices. That should be more than enough to keep them focussed on creating shareholder value!

While insiders already own a significant amount of shares, and they have been buying more, the good news for ordinary shareholders does not stop there. That's because on our analysis the CEO, Paresh Shah, is paid less than the median for similar sized companies. For companies with market capitalizations under ₹15b, like Allied Digital Services, the median CEO pay is around ₹2.9m.

The CEO of Allied Digital Services was paid just ₹1.2m in total compensation for the year ending . You could consider this pay as somewhat symbolic, which suggests the CEO does not need a lot of compensation to stay motivated. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of a culture of integrity, in a broader sense.

Is Allied Digital Services Worth Keeping An Eye On?

Allied Digital Services's earnings per share growth have been levitating higher, like a mountain goat scaling the Alps. The cherry on top is that insiders own a bunch of shares, and one has been buying more. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe Allied Digital Services deserves timely attention. You should always think about risks though. Case in point, we've spotted 5 warning signs for Allied Digital Services you should be aware of.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Allied Digital Services, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:ADSL

Allied Digital Services

Designs, develops, deploys, and delivers end-to-end IT infrastructure services and digital solutions in India, rest of Asia, the United States, Australia, Europe, and the Middle East.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026