If You Like EPS Growth Then Check Out 3i Infotech (NSE:3IINFOLTD) Before It's Too Late

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in 3i Infotech (NSE:3IINFOLTD). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

See our latest analysis for 3i Infotech

How Fast Is 3i Infotech Growing Its Earnings Per Share?

In a capitalist society capital chases profits, and that means share prices tend rise with earnings per share (EPS). So like the hint of a smile on a face that I love, growing EPS generally makes me look twice. You can imagine, then, that it almost knocked my socks off when I realized that 3i Infotech grew its EPS from ₹4.49 to ₹14.74, in one short year. Even though that growth rate is unlikely to be repeated, that looks like a breakout improvement.

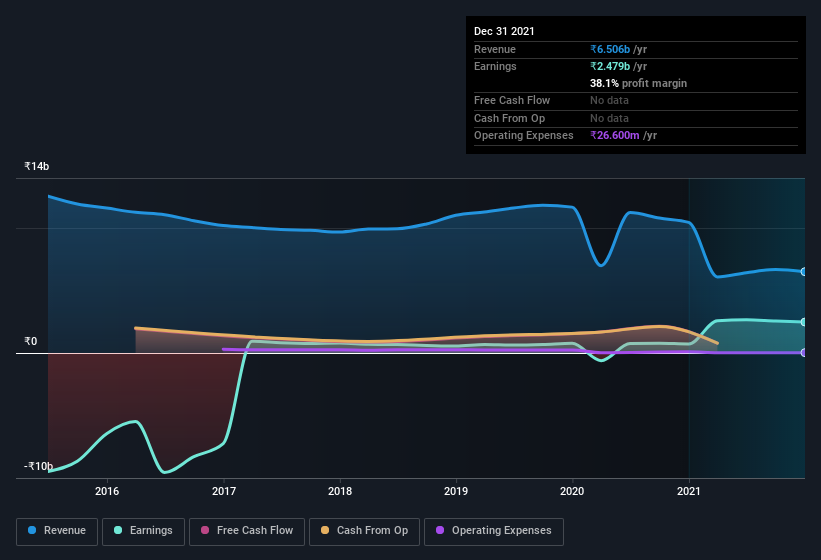

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. To cut to the chase 3i Infotech's EBIT margins dropped last year, and so did its revenue. That is, not a hint of euphemism here, suboptimal.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

Since 3i Infotech is no giant, with a market capitalization of ₹8.5b, so you should definitely check its cash and debt before getting too excited about its prospects.

Are 3i Infotech Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Like a sturdy phalanx 3i Infotech insiders have stood united by refusing to sell shares over the last year. But my excitement comes from the ₹5.5m that Pravir Vohra spent buying shares (at an average price of about ₹109).

It's reassuring that 3i Infotech insiders are buying the stock, but that's not the only reason to think management are fair to shareholders. I refer to the very reasonable level of CEO pay. For companies with market capitalizations under ₹15b, like 3i Infotech, the median CEO pay is around ₹3.0m.

The 3i Infotech CEO received total compensation of only ₹459k in the year to . You could consider this pay as somewhat symbolic, which suggests the CEO does not need a lot of compensation to stay motivated. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. I'd also argue reasonable pay levels attest to good decision making more generally.

Should You Add 3i Infotech To Your Watchlist?

3i Infotech's earnings have taken off like any random crypto-currency did, back in 2017. Better yet, we can observe insider buying and the chief executive pay looks reasonable. It could be that 3i Infotech is at an inflection point, given the EPS growth. For those chasing fast growth, then, I'd suggest to stock merits monitoring. We don't want to rain on the parade too much, but we did also find 3 warning signs for 3i Infotech that you need to be mindful of.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of 3i Infotech, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if 3i Infotech might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:3IINFOLTD

3i Infotech

Provides IP based software solutions in India, the United States, the United Kingdom, the Middle East, Africa, South Asia, the Asia Pacific, and internationally.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives