- India

- /

- Capital Markets

- /

- NSEI:WELINV

Here's Why I Think Welspun Investments and Commercials (NSE:WELINV) Might Deserve Your Attention Today

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like Welspun Investments and Commercials (NSE:WELINV). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

View our latest analysis for Welspun Investments and Commercials

Welspun Investments and Commercials's Improving Profits

In a capitalist society capital chases profits, and that means share prices tend rise with earnings per share (EPS). So like the hint of a smile on a face that I love, growing EPS generally makes me look twice. It is therefore awe-striking that Welspun Investments and Commercials's EPS went from ₹2.22 to ₹19.87 in just one year. When you see earnings grow that quickly, it often means good things ahead for the company. But the key is discerning whether something profound has changed, or if this is a just a one-off boost.

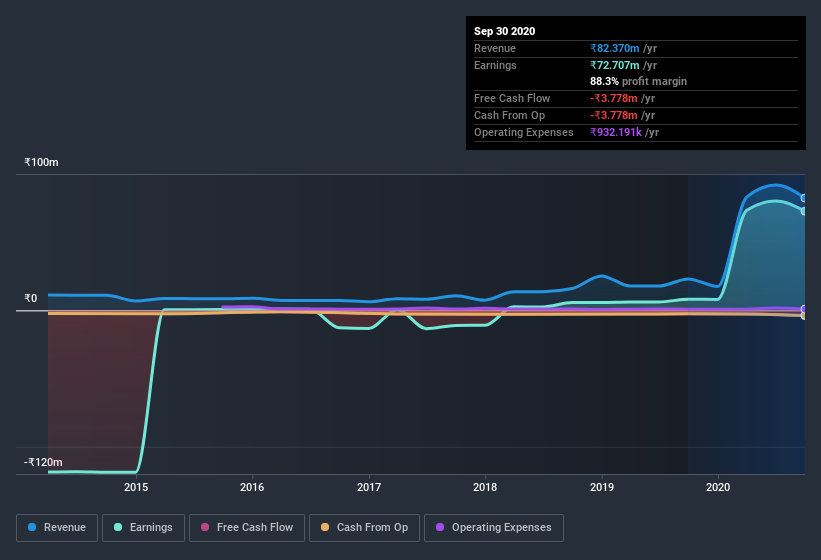

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. The good news is that Welspun Investments and Commercials is growing revenues, and EBIT margins improved by 59.4 percentage points to 92%, over the last year. That's great to see, on both counts.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

Welspun Investments and Commercials isn't a huge company, given its market capitalization of ₹1.3b. That makes it extra important to check on its balance sheet strength.

Are Welspun Investments and Commercials Insiders Aligned With All Shareholders?

I always like to check up on CEO compensation, because I think that reasonable pay levels, around or below the median, can be a sign that shareholder interests are well considered. For companies with market capitalizations under ₹15b, like Welspun Investments and Commercials, the median CEO pay is around ₹3.3m.

The CEO of Welspun Investments and Commercials was paid just ₹180k in total compensation for the year ending . You could consider this pay as somewhat symbolic, which suggests the CEO does not need a lot of compensation to stay motivated. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of a culture of integrity, in a broader sense.

Is Welspun Investments and Commercials Worth Keeping An Eye On?

Welspun Investments and Commercials's earnings per share have taken off like a rocket aimed right at the moon. With rocketing profits, its seems likely the business has a rosy future; and it may have hit an inflection point. Meanwhile, the very reasonable CEO pay reassures me a little, since it points to an absence profligacy. While I couldn't be sure without a deeper dive, it does seem that Welspun Investments and Commercials has the hallmarks of a quality business; and that would make it well worth watching. What about risks? Every company has them, and we've spotted 3 warning signs for Welspun Investments and Commercials you should know about.

You can invest in any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you decide to trade Welspun Investments and Commercials, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

If you're looking to trade Welspun Investments and Commercials, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Welspun Investments and Commercials might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:WELINV

Welspun Investments and Commercials

A core investment company, engages in the investment and dealing of shares and securities in India.

Excellent balance sheet slight.

Market Insights

Community Narratives