- India

- /

- General Merchandise and Department Stores

- /

- NSEI:VMART

Shareholders in V-Mart Retail (NSE:VMART) have lost 46%, as stock drops 13% this past week

Investors can approximate the average market return by buying an index fund. When you buy individual stocks, you can make higher profits, but you also face the risk of under-performance. Unfortunately the V-Mart Retail Limited (NSE:VMART) share price slid 46% over twelve months. That's disappointing when you consider the market returned 13%. However, the longer term returns haven't been so bad, with the stock down 16% in the last three years. Shareholders have had an even rougher run lately, with the share price down 29% in the last 90 days.

After losing 13% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

See our latest analysis for V-Mart Retail

Because V-Mart Retail made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last twelve months, V-Mart Retail increased its revenue by 23%. We think that is pretty nice growth. Unfortunately that wasn't good enough to stop the share price dropping 46%. This implies the market was expecting better growth. However, that's in the past now, and it's the future that matters most.

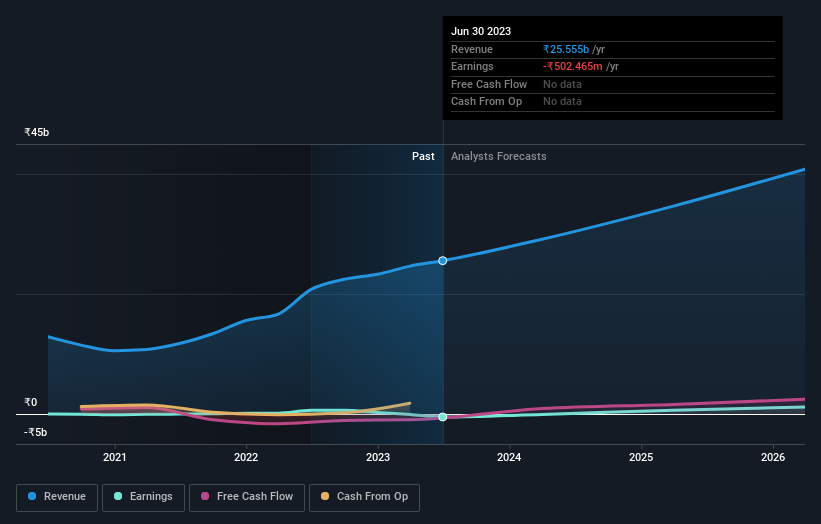

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

V-Mart Retail is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. You can see what analysts are predicting for V-Mart Retail in this interactive graph of future profit estimates.

A Different Perspective

Investors in V-Mart Retail had a tough year, with a total loss of 46%, against a market gain of about 13%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 7% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - V-Mart Retail has 1 warning sign we think you should be aware of.

But note: V-Mart Retail may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Indian exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:VMART

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives