- India

- /

- Specialty Stores

- /

- NSEI:V2RETAIL

After Leaping 26% V2 Retail Limited (NSE:V2RETAIL) Shares Are Not Flying Under The Radar

Despite an already strong run, V2 Retail Limited (NSE:V2RETAIL) shares have been powering on, with a gain of 26% in the last thirty days. The last 30 days were the cherry on top of the stock's 696% gain in the last year, which is nothing short of spectacular.

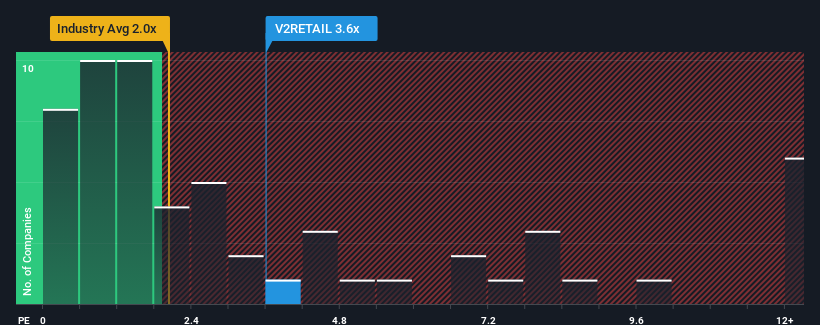

Since its price has surged higher, you could be forgiven for thinking V2 Retail is a stock not worth researching with a price-to-sales ratios (or "P/S") of 3.6x, considering almost half the companies in India's Specialty Retail industry have P/S ratios below 2x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

Check out our latest analysis for V2 Retail

How Has V2 Retail Performed Recently?

V2 Retail could be doing better as it's been growing revenue less than most other companies lately. It might be that many expect the uninspiring revenue performance to recover significantly, which has kept the P/S ratio from collapsing. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on V2 Retail.Is There Enough Revenue Growth Forecasted For V2 Retail?

There's an inherent assumption that a company should outperform the industry for P/S ratios like V2 Retail's to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 48% last year. The strong recent performance means it was also able to grow revenue by 125% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 48% as estimated by the only analyst watching the company. Meanwhile, the rest of the industry is forecast to only expand by 34%, which is noticeably less attractive.

With this in mind, it's not hard to understand why V2 Retail's P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

V2 Retail shares have taken a big step in a northerly direction, but its P/S is elevated as a result. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our look into V2 Retail shows that its P/S ratio remains high on the merit of its strong future revenues. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

It is also worth noting that we have found 1 warning sign for V2 Retail that you need to take into consideration.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:V2RETAIL

V2 Retail

Together with its subsidiary, V2 Smart Manufacturing Private Limited, engages in the retail trade of apparel and garments, textiles, and accessories in India.

Solid track record with limited growth.

Similar Companies

Market Insights

Community Narratives