- India

- /

- Retail Distributors

- /

- NSEI:SIRCA

Here's Why Sirca Paints India (NSE:SIRCA) Has Caught The Eye Of Investors

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Sirca Paints India (NSE:SIRCA). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

Check out our latest analysis for Sirca Paints India

Sirca Paints India's Improving Profits

In the last three years Sirca Paints India's earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. Thus, it makes sense to focus on more recent growth rates, instead. Sirca Paints India boosted its trailing twelve month EPS from ₹7.81 to ₹8.83, in the last year. This amounts to a 13% gain; a figure that shareholders will be pleased to see.

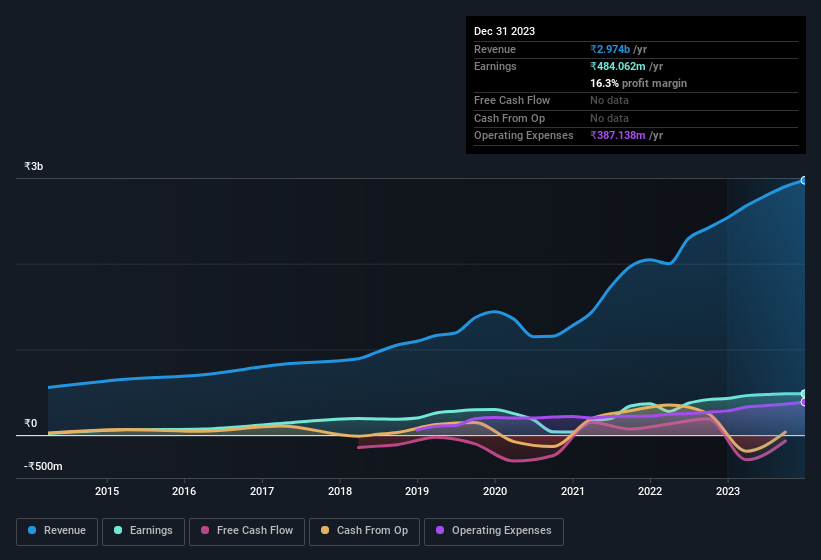

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. Sirca Paints India maintained stable EBIT margins over the last year, all while growing revenue 17% to ₹3.0b. That's a real positive.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

Sirca Paints India isn't a huge company, given its market capitalisation of ₹18b. That makes it extra important to check on its balance sheet strength.

Are Sirca Paints India Insiders Aligned With All Shareholders?

Many consider high insider ownership to be a strong sign of alignment between the leaders of a company and the ordinary shareholders. So we're pleased to report that Sirca Paints India insiders own a meaningful share of the business. To be exact, company insiders hold 56% of the company, so their decisions have a significant impact on their investments. This makes it apparent they will be incentivised to plan for the long term - a positive for shareholders with a sit and hold strategy. In terms of absolute value, insiders have ₹10b invested in the business, at the current share price. That's nothing to sneeze at!

It means a lot to see insiders invested in the business, but shareholders may be wondering if remuneration policies are in their best interest. Our quick analysis into CEO remuneration would seem to indicate they are. For companies with market capitalisations between ₹8.3b and ₹33b, like Sirca Paints India, the median CEO pay is around ₹16m.

The Sirca Paints India CEO received ₹12m in compensation for the year ending March 2023. That comes in below the average for similar sized companies and seems pretty reasonable. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of good governance, more generally.

Is Sirca Paints India Worth Keeping An Eye On?

One positive for Sirca Paints India is that it is growing EPS. That's nice to see. The fact that EPS is growing is a genuine positive for Sirca Paints India, but the pleasant picture gets better than that. With company insiders aligning themselves considerably with the company's success and modest CEO compensation, there's no arguments that this is a stock worth looking into. You should always think about risks though. Case in point, we've spotted 1 warning sign for Sirca Paints India you should be aware of.

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a tailored list of Indian companies which have demonstrated growth backed by recent insider purchases.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:SIRCA

Sirca Paints India

Engages in the import and distribution of wood, glass, and metal coatings in India.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives