- India

- /

- General Merchandise and Department Stores

- /

- NSEI:SHOPERSTOP

Shoppers Stop Limited (NSE:SHOPERSTOP) Might Not Be As Mispriced As It Looks After Plunging 26%

Shoppers Stop Limited (NSE:SHOPERSTOP) shareholders won't be pleased to see that the share price has had a very rough month, dropping 26% and undoing the prior period's positive performance. Indeed, the recent drop has reduced its annual gain to a relatively sedate 3.2% over the last twelve months.

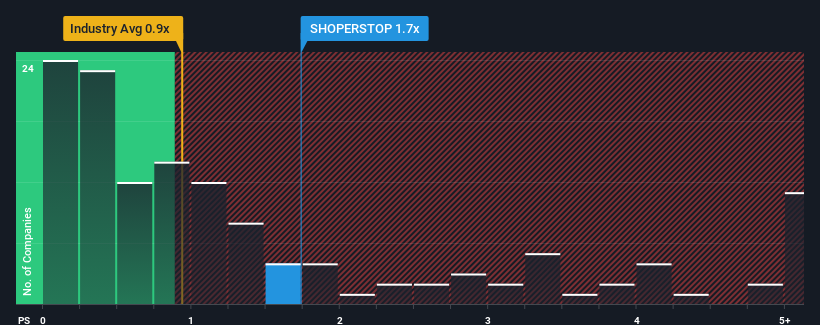

Even after such a large drop in price, Shoppers Stop may still be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 1.6x, since almost half of all companies in the Multiline Retail industry in India have P/S ratios greater than 4.5x and even P/S higher than 66x are not unusual. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Shoppers Stop

How Shoppers Stop Has Been Performing

Recent times haven't been great for Shoppers Stop as its revenue has been rising slower than most other companies. The P/S ratio is probably low because investors think this lacklustre revenue performance isn't going to get any better. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Shoppers Stop.How Is Shoppers Stop's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as depressed as Shoppers Stop's is when the company's growth is on track to lag the industry decidedly.

Retrospectively, the last year delivered a decent 9.1% gain to the company's revenues. Pleasingly, revenue has also lifted 99% in aggregate from three years ago, partly thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 12% as estimated by the eight analysts watching the company. With the industry predicted to deliver 9.9% growth , the company is positioned for a comparable revenue result.

With this in consideration, we find it intriguing that Shoppers Stop's P/S is lagging behind its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

The Key Takeaway

Shares in Shoppers Stop have plummeted and its P/S has followed suit. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

It looks to us like the P/S figures for Shoppers Stop remain low despite growth that is expected to be in line with other companies in the industry. The low P/S could be an indication that the revenue growth estimates are being questioned by the market. It appears some are indeed anticipating revenue instability, because these conditions should normally provide more support to the share price.

It is also worth noting that we have found 4 warning signs for Shoppers Stop (1 is potentially serious!) that you need to take into consideration.

If these risks are making you reconsider your opinion on Shoppers Stop, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:SHOPERSTOP

Shoppers Stop

Engages in the retail of various household and consumer products through retail and departmental stores in India.

High growth potential and fair value.

Similar Companies

Market Insights

Community Narratives