- India

- /

- General Merchandise and Department Stores

- /

- NSEI:RTNINDIA

Recent 6.3% pullback isn't enough to hurt long-term RattanIndia Enterprises (NSE:RTNINDIA) shareholders, they're still up 736% over 5 years

We think all investors should try to buy and hold high quality multi-year winners. While the best companies are hard to find, but they can generate massive returns over long periods. For example, the RattanIndia Enterprises Limited (NSE:RTNINDIA) share price is up a whopping 736% in the last half decade, a handsome return for long term holders. And this is just one example of the epic gains achieved by some long term investors. But it's down 6.3% in the last week. It may be that the recent financial results disappointed, so check out the latest revenue and profit numbers on in our company report.' We love happy stories like this one. The company should be really proud of that performance!

While the stock has fallen 6.3% this week, it's worth focusing on the longer term and seeing if the stocks historical returns have been driven by the underlying fundamentals.

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

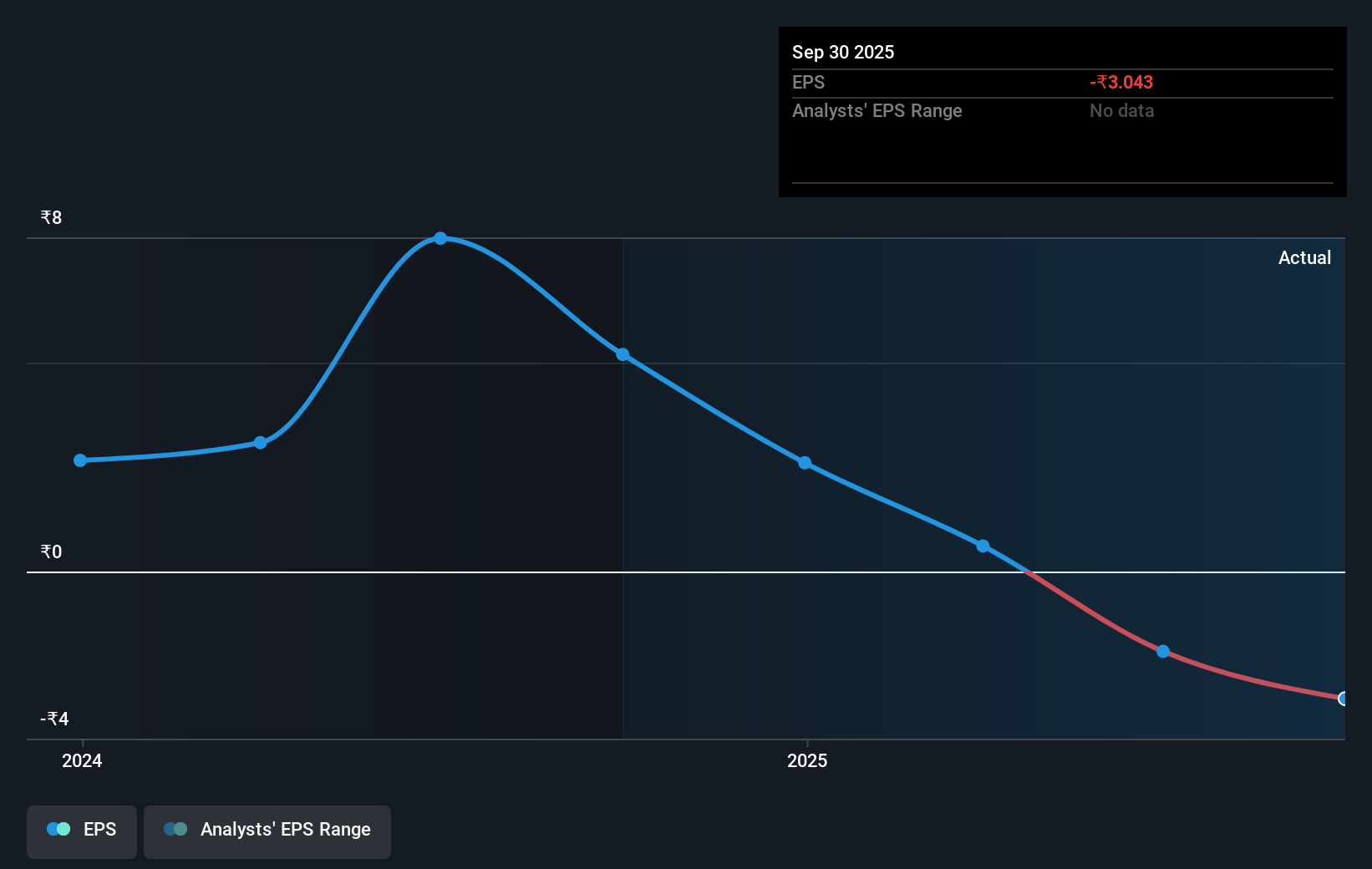

During five years of share price growth, RattanIndia Enterprises achieved compound earnings per share (EPS) growth of 7.2% per year. This EPS growth is slower than the share price growth of 53% per year, over the same period. So it's fair to assume the market has a higher opinion of the business than it did five years ago. And that's hardly shocking given the track record of growth.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

This free interactive report on RattanIndia Enterprises' earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

Investors in RattanIndia Enterprises had a tough year, with a total loss of 23%, against a market gain of about 4.6%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Longer term investors wouldn't be so upset, since they would have made 53%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. Shareholders might want to examine this detailed historical graph of past earnings, revenue and cash flow.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Indian exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:RTNINDIA

RattanIndia Enterprises

Engages in the retail business in India and internationally.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives