- India

- /

- Specialty Stores

- /

- NSEI:MVGJL

Is Manoj Vaibhav Gems 'N' Jewellers (NSE:MVGJL) A Risky Investment?

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. Importantly, Manoj Vaibhav Gems 'N' Jewellers Limited (NSE:MVGJL) does carry debt. But the real question is whether this debt is making the company risky.

When Is Debt A Problem?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

How Much Debt Does Manoj Vaibhav Gems 'N' Jewellers Carry?

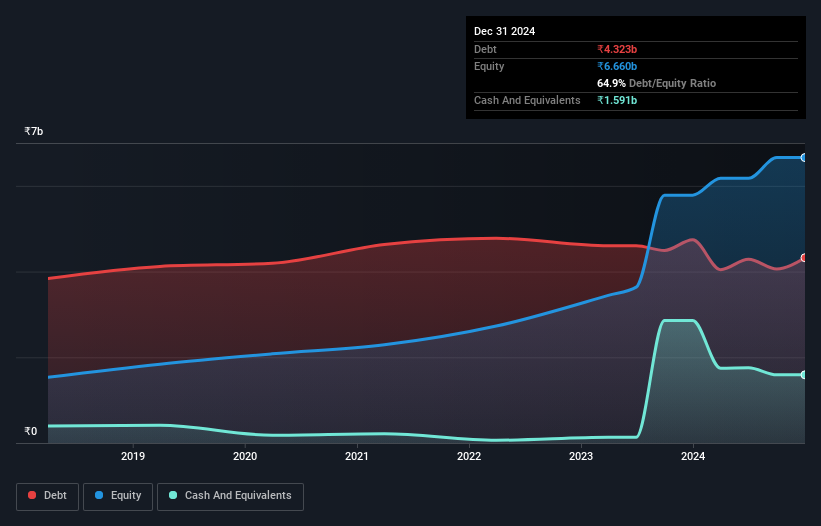

As you can see below, Manoj Vaibhav Gems 'N' Jewellers had ₹4.32b of debt at September 2024, down from ₹4.74b a year prior. However, it also had ₹1.59b in cash, and so its net debt is ₹2.73b.

A Look At Manoj Vaibhav Gems 'N' Jewellers' Liabilities

Zooming in on the latest balance sheet data, we can see that Manoj Vaibhav Gems 'N' Jewellers had liabilities of ₹7.71b due within 12 months and liabilities of ₹493.1m due beyond that. Offsetting this, it had ₹1.59b in cash and ₹444.9m in receivables that were due within 12 months. So it has liabilities totalling ₹6.17b more than its cash and near-term receivables, combined.

While this might seem like a lot, it is not so bad since Manoj Vaibhav Gems 'N' Jewellers has a market capitalization of ₹10.7b, and so it could probably strengthen its balance sheet by raising capital if it needed to. However, it is still worthwhile taking a close look at its ability to pay off debt.

View our latest analysis for Manoj Vaibhav Gems 'N' Jewellers

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Manoj Vaibhav Gems 'N' Jewellers has net debt worth 1.8 times EBITDA, which isn't too much, but its interest cover looks a bit on the low side, with EBIT at only 5.4 times the interest expense. While that doesn't worry us too much, it does suggest the interest payments are somewhat of a burden. Manoj Vaibhav Gems 'N' Jewellers grew its EBIT by 7.8% in the last year. Whilst that hardly knocks our socks off it is a positive when it comes to debt. The balance sheet is clearly the area to focus on when you are analysing debt. But it is Manoj Vaibhav Gems 'N' Jewellers's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. Looking at the most recent three years, Manoj Vaibhav Gems 'N' Jewellers recorded free cash flow of 24% of its EBIT, which is weaker than we'd expect. That's not great, when it comes to paying down debt.

Our View

Both Manoj Vaibhav Gems 'N' Jewellers's conversion of EBIT to free cash flow and its level of total liabilities were discouraging. At least its EBIT growth rate gives us reason to be optimistic. We think that Manoj Vaibhav Gems 'N' Jewellers's debt does make it a bit risky, after considering the aforementioned data points together. Not all risk is bad, as it can boost share price returns if it pays off, but this debt risk is worth keeping in mind. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. To that end, you should be aware of the 2 warning signs we've spotted with Manoj Vaibhav Gems 'N' Jewellers .

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:MVGJL

Manoj Vaibhav Gems 'N' Jewellers

Engages in the jewelry retail business under the Vaibhav Jewellers brand in India.

Adequate balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.