- India

- /

- Retail Distributors

- /

- NSEI:MITTAL

Some Confidence Is Lacking In Mittal Life Style Limited (NSE:MITTAL) As Shares Slide 32%

Mittal Life Style Limited (NSE:MITTAL) shares have had a horrible month, losing 32% after a relatively good period beforehand. Looking at the bigger picture, even after this poor month the stock is up 87% in the last year.

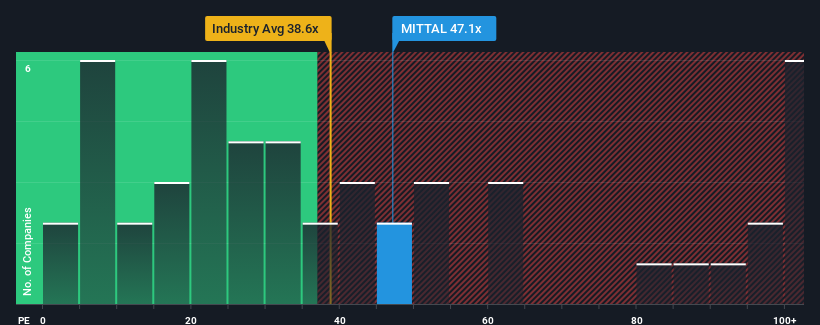

In spite of the heavy fall in price, Mittal Life Style's price-to-earnings (or "P/E") ratio of 47.1x might still make it look like a strong sell right now compared to the market in India, where around half of the companies have P/E ratios below 29x and even P/E's below 16x are quite common. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

Recent times have been quite advantageous for Mittal Life Style as its earnings have been rising very briskly. The P/E is probably high because investors think this strong earnings growth will be enough to outperform the broader market in the near future. If not, then existing shareholders might be a little nervous about the viability of the share price.

Check out our latest analysis for Mittal Life Style

How Is Mittal Life Style's Growth Trending?

In order to justify its P/E ratio, Mittal Life Style would need to produce outstanding growth well in excess of the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 157% last year. However, this wasn't enough as the latest three year period has seen a very unpleasant 48% drop in EPS in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Weighing that medium-term earnings trajectory against the broader market's one-year forecast for expansion of 24% shows it's an unpleasant look.

In light of this, it's alarming that Mittal Life Style's P/E sits above the majority of other companies. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh heavily on the share price eventually.

The Final Word

Even after such a strong price drop, Mittal Life Style's P/E still exceeds the rest of the market significantly. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Mittal Life Style currently trades on a much higher than expected P/E since its recent earnings have been in decline over the medium-term. When we see earnings heading backwards and underperforming the market forecasts, we suspect the share price is at risk of declining, sending the high P/E lower. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these prices as being reasonable.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 5 warning signs with Mittal Life Style (at least 2 which are significant), and understanding these should be part of your investment process.

Of course, you might also be able to find a better stock than Mittal Life Style. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:MITTAL

Mittal Life Style

Engages in supply of bottom weight fabrics and denims in India.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives