- India

- /

- Specialty Stores

- /

- NSEI:EMIL

Electronics Mart India Limited's (NSE:EMIL) Shares May Have Run Too Fast Too Soon

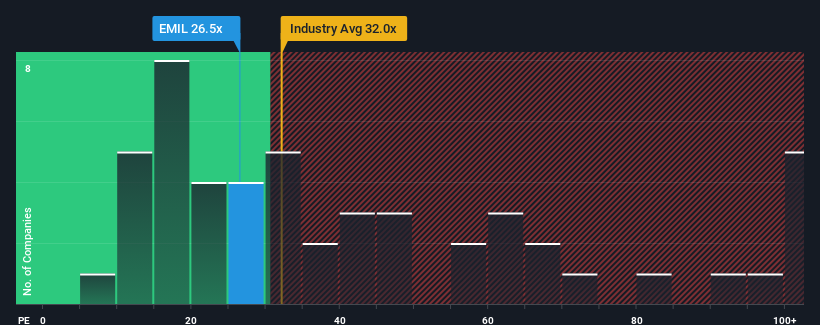

With a median price-to-earnings (or "P/E") ratio of close to 25x in India, you could be forgiven for feeling indifferent about Electronics Mart India Limited's (NSE:EMIL) P/E ratio of 26.5x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Electronics Mart India hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. One possibility is that the P/E is moderate because investors think this poor earnings performance will turn around. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

See our latest analysis for Electronics Mart India

How Is Electronics Mart India's Growth Trending?

The only time you'd be comfortable seeing a P/E like Electronics Mart India's is when the company's growth is tracking the market closely.

Retrospectively, the last year delivered a frustrating 6.0% decrease to the company's bottom line. This has soured the latest three-year period, which nevertheless managed to deliver a decent 27% overall rise in EPS. So we can start by confirming that the company has generally done a good job of growing earnings over that time, even though it had some hiccups along the way.

Turning to the outlook, the next year should generate growth of 22% as estimated by the five analysts watching the company. With the market predicted to deliver 25% growth , the company is positioned for a weaker earnings result.

In light of this, it's curious that Electronics Mart India's P/E sits in line with the majority of other companies. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as this level of earnings growth is likely to weigh down the shares eventually.

The Key Takeaway

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Electronics Mart India currently trades on a higher than expected P/E since its forecast growth is lower than the wider market. Right now we are uncomfortable with the P/E as the predicted future earnings aren't likely to support a more positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Electronics Mart India, and understanding should be part of your investment process.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Valuation is complex, but we're here to simplify it.

Discover if Electronics Mart India might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:EMIL

Electronics Mart India

Engages in the sale of consumer electronics and durable products in India.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives