- India

- /

- Specialty Stores

- /

- NSEI:ARVINDFASN

Would Shareholders Who Purchased Arvind Fashions' (NSE:ARVINDFASN) Stock Year Be Happy With The Share price Today?

While not a mind-blowing move, it is good to see that the Arvind Fashions Limited (NSE:ARVINDFASN) share price has gained 18% in the last three months. But that's not enough to compensate for the decline over the last twelve months. Like a receding glacier in a warming world, the share price has melted 63% in that period. It's not that amazing to see a bounce after a drop like that. It may be that the fall was an overreaction.

View our latest analysis for Arvind Fashions

Arvind Fashions isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

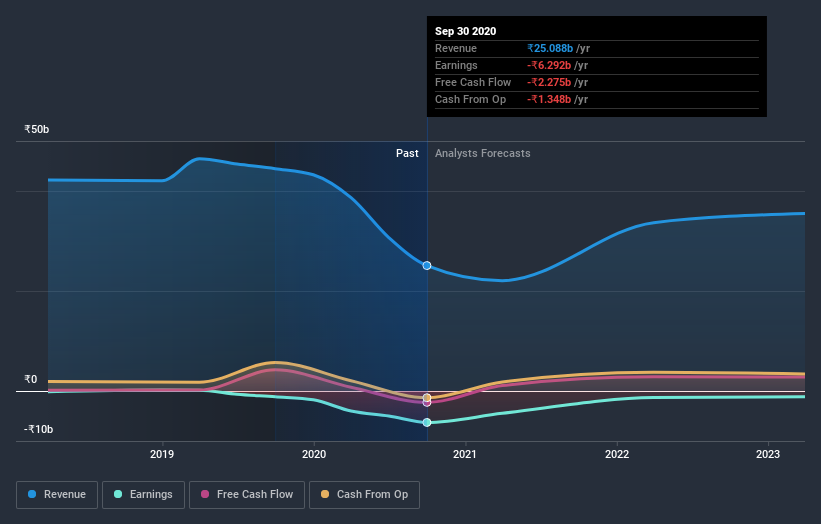

Arvind Fashions' revenue didn't grow at all in the last year. In fact, it fell 44%. That looks pretty grim, at a glance. In the absence of profits, it's not unreasonable that the share price fell 63%. Having said that, if growth is coming in the future, the stock may have better days ahead. We don't generally like to own companies with falling revenues and no profits, so we're pretty cautious of this one, at the moment.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

If you are thinking of buying or selling Arvind Fashions stock, you should check out this FREE detailed report on its balance sheet.

What about the Total Shareholder Return (TSR)?

Investors should note that there's a difference between Arvind Fashions' total shareholder return (TSR) and its share price change, which we've covered above. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. We note that Arvind Fashions' TSR, at -52% is higher than its share price return of -63%. When you consider it hasn't been paying a dividend, this data suggests shareholders have benefitted from a spin-off, or had the opportunity to acquire attractively priced shares in a discounted capital raising.

A Different Perspective

While Arvind Fashions shareholders are down 52% for the year, the market itself is up 17%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. It's great to see a nice little 18% rebound in the last three months. This could just be a bounce because the selling was too aggressive, but fingers crossed it's the start of a new trend. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - Arvind Fashions has 3 warning signs (and 1 which shouldn't be ignored) we think you should know about.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

If you decide to trade Arvind Fashions, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:ARVINDFASN

Arvind Fashions

Engages in the wholesale and retail trading of garments and accessories in India and internationally.

Solid track record with excellent balance sheet.