- India

- /

- Specialty Stores

- /

- NSEI:ARVINDFASN

Indian Stocks Estimated To Be Trading Below Intrinsic Value In August 2024

Reviewed by Simply Wall St

Over the last 7 days, the Indian market has remained flat. However, over the past 12 months, it has risen by an impressive 44%, with earnings forecasted to grow by 17% annually. In this context, identifying stocks that are trading below their intrinsic value can offer significant opportunities for investors looking to capitalize on potential growth.

Top 10 Undervalued Stocks Based On Cash Flows In India

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Everest Kanto Cylinder (NSEI:EKC) | ₹190.68 | ₹305.60 | 37.6% |

| Krsnaa Diagnostics (NSEI:KRSNAA) | ₹726.90 | ₹1165.33 | 37.6% |

| Yatharth Hospital & Trauma Care Services (NSEI:YATHARTH) | ₹476.40 | ₹792.08 | 39.9% |

| Venus Pipes and Tubes (NSEI:VENUSPIPES) | ₹2207.05 | ₹4359.43 | 49.4% |

| Updater Services (NSEI:UDS) | ₹324.60 | ₹621.89 | 47.8% |

| IOL Chemicals and Pharmaceuticals (BSE:524164) | ₹434.10 | ₹762.32 | 43.1% |

| Prataap Snacks (NSEI:DIAMONDYD) | ₹874.75 | ₹1509.79 | 42.1% |

| Patel Engineering (BSE:531120) | ₹53.85 | ₹90.83 | 40.7% |

| Manorama Industries (BSE:541974) | ₹834.15 | ₹1665.51 | 49.9% |

| Strides Pharma Science (NSEI:STAR) | ₹1276.75 | ₹2032.10 | 37.2% |

Let's explore several standout options from the results in the screener.

Arvind Fashions (NSEI:ARVINDFASN)

Overview: Arvind Fashions Limited is involved in the wholesale and retail trading of garments and accessories both in India and internationally, with a market cap of ₹63.30 billion.

Operations: Branded Apparel, including garments and accessories, is a key revenue segment for Arvind Fashions Limited, generating ₹43.47 billion.

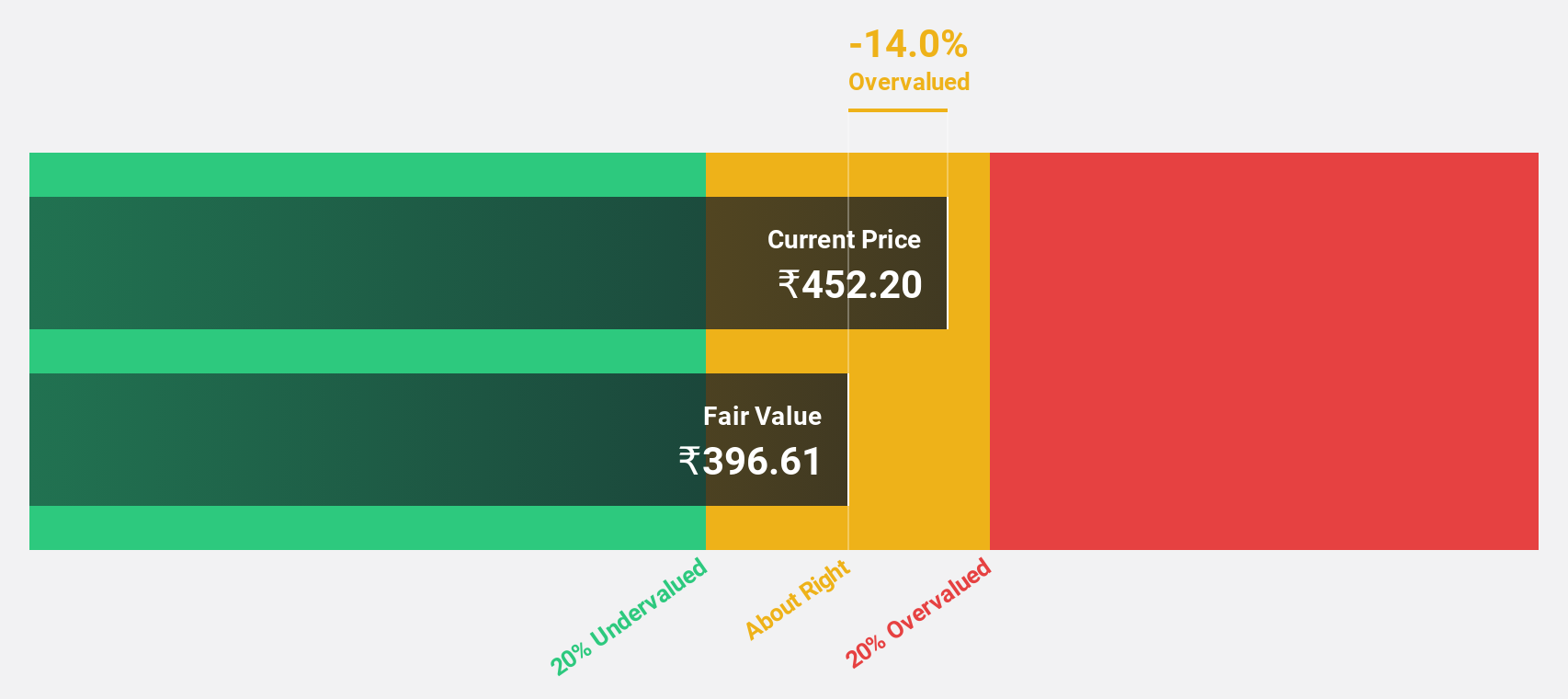

Estimated Discount To Fair Value: 14.4%

Arvind Fashions' recent earnings report shows a significant turnaround with net income rising to ₹13.2 million from a loss of ₹164.3 million year-over-year, highlighting improved cash flows. Trading at ₹487.5, it is undervalued against its estimated fair value of ₹569.31 and is expected to see annual profit growth of 46.9%. However, interest payments are not well covered by earnings, and the dividend track record remains unstable despite proposed increases.

- Our comprehensive growth report raises the possibility that Arvind Fashions is poised for substantial financial growth.

- Take a closer look at Arvind Fashions' balance sheet health here in our report.

Quess (NSEI:QUESS)

Overview: Quess Corp Limited is a business services provider operating in India, South East Asia, the Middle East, and North America with a market cap of ₹105.16 billion.

Operations: Quess generates revenue from four main segments: Product Led Business (₹4.29 billion), Workforce Management (₹138.44 billion), Operating Asset Management (₹28.43 billion), and Global Technology Solutions excluding Product Led Business (₹23.87 billion).

Estimated Discount To Fair Value: 10.4%

Quess Corp Limited reported strong Q1 2024 earnings with net income rising to ₹1.04 billion from ₹478.11 million year-over-year, reflecting improved cash flows. Trading at ₹716.75, it is 10.4% below its estimated fair value of ₹799.58 and forecasts suggest annual profit growth of 23%, outpacing the Indian market's 16.9%. However, the company has an unstable dividend track record and its Return on Equity is forecasted to be low at 16.9% in three years.

- Our growth report here indicates Quess may be poised for an improving outlook.

- Click to explore a detailed breakdown of our findings in Quess' balance sheet health report.

Venus Pipes and Tubes (NSEI:VENUSPIPES)

Overview: Venus Pipes and Tubes Limited manufactures and sells stainless-steel pipes and tubes in India and internationally, with a market cap of ₹42.76 billion.

Operations: The company's revenue segments include ₹8.63 billion from the manufacturing and trading of pipes, tubes, and steel.

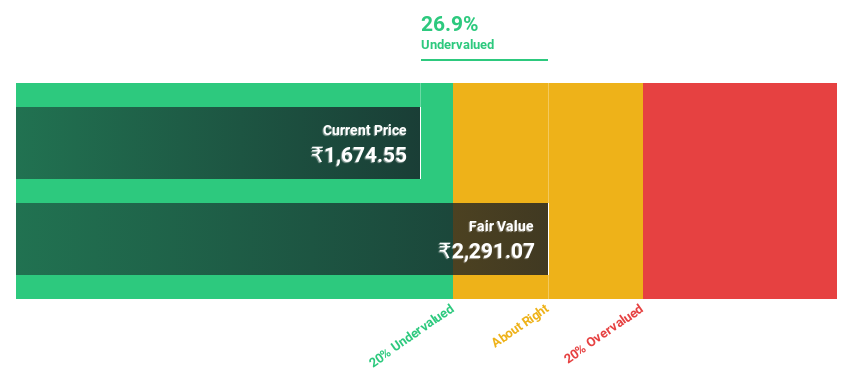

Estimated Discount To Fair Value: 49.4%

Venus Pipes and Tubes is trading at ₹2207.05, significantly below its estimated fair value of ₹4359.43, indicating it may be undervalued based on cash flows. The company reported strong Q1 2024 earnings with net income of ₹275.56 million compared to ₹174.06 million a year ago, reflecting improved financial performance. Earnings are forecast to grow 29.27% annually over the next three years, outpacing the Indian market's growth rate and suggesting robust future prospects despite recent market volatility.

- Upon reviewing our latest growth report, Venus Pipes and Tubes' projected financial performance appears quite optimistic.

- Get an in-depth perspective on Venus Pipes and Tubes' balance sheet by reading our health report here.

Turning Ideas Into Actions

- Delve into our full catalog of 31 Undervalued Indian Stocks Based On Cash Flows here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:ARVINDFASN

Arvind Fashions

Engages in the wholesale and retail trading of garments and accessories in India and internationally.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives