- India

- /

- Specialty Stores

- /

- NSEI:ABFRL

Those who invested in Aditya Birla Fashion and Retail (NSE:ABFRL) five years ago are up 68%

When you buy and hold a stock for the long term, you definitely want it to provide a positive return. Better yet, you'd like to see the share price move up more than the market average. Unfortunately for shareholders, while the Aditya Birla Fashion and Retail Limited (NSE:ABFRL) share price is up 66% in the last five years, that's less than the market return. On a brighter note, more newer shareholders are probably rather content with the 34% share price gain over twelve months.

So let's investigate and see if the longer term performance of the company has been in line with the underlying business' progress.

View our latest analysis for Aditya Birla Fashion and Retail

Aditya Birla Fashion and Retail wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally hope to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

For the last half decade, Aditya Birla Fashion and Retail can boast revenue growth at a rate of 16% per year. That's well above most pre-profit companies. It's nice to see shareholders have made a profit, but the gain of 11% over the period isn't that impressive compared to the overall market. You could argue the market is still pretty skeptical, given the growing revenues. It could be that the stock was previously over-priced - but if you're looking for underappreciated growth stocks, these numbers indicate that there might be an opportunity here.

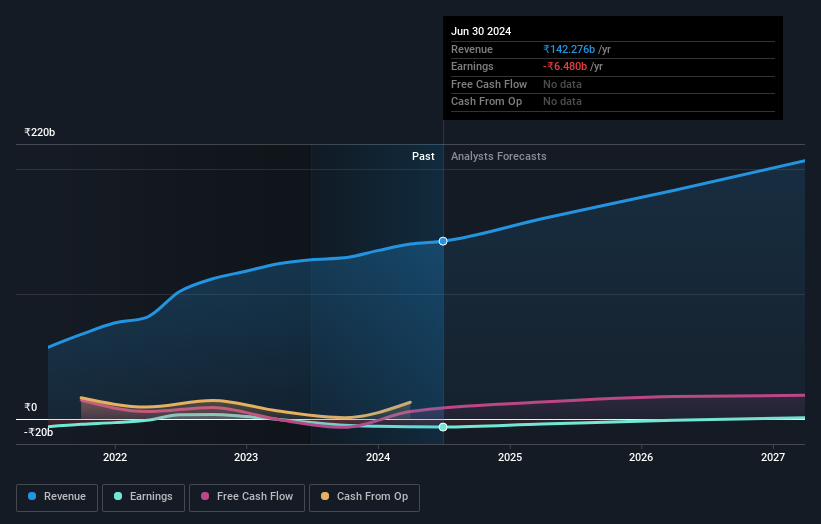

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Aditya Birla Fashion and Retail is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. So we recommend checking out this free report showing consensus forecasts

What About The Total Shareholder Return (TSR)?

We've already covered Aditya Birla Fashion and Retail's share price action, but we should also mention its total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. We note that Aditya Birla Fashion and Retail's TSR, at 68% is higher than its share price return of 66%. When you consider it hasn't been paying a dividend, this data suggests shareholders have benefitted from a spin-off, or had the opportunity to acquire attractively priced shares in a discounted capital raising.

A Different Perspective

Aditya Birla Fashion and Retail shareholders gained a total return of 34% during the year. But that was short of the market average. On the bright side, that's still a gain, and it's actually better than the average return of 11% over half a decade This suggests the company might be improving over time. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with Aditya Birla Fashion and Retail , and understanding them should be part of your investment process.

Of course Aditya Birla Fashion and Retail may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Indian exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:ABFRL

Aditya Birla Fashion and Retail

Manufactures, distributes, and retails fashion apparel and accessories in India and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives