- India

- /

- Specialty Stores

- /

- NSEI:ABFRL

Aditya Birla Fashion and Retail (NSE:ABFRL) shareholders have earned a 12% CAGR over the last three years

Low-cost index funds make it easy to achieve average market returns. But if you invest in individual stocks, some are likely to underperform. That's what has happened with the Aditya Birla Fashion and Retail Limited (NSE:ABFRL) share price. It's up 39% over three years, but that is below the market return. Disappointingly, the share price is down 30% in the last year.

So let's assess the underlying fundamentals over the last 3 years and see if they've moved in lock-step with shareholder returns.

Check out our latest analysis for Aditya Birla Fashion and Retail

Because Aditya Birla Fashion and Retail made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last 3 years Aditya Birla Fashion and Retail saw its revenue grow at 32% per year. That's well above most pre-profit companies. While long-term shareholders have made money, the 12% per year gain over three years isn't that great given the rising market. We would have thought the top-line growth might have impressed buyers more. If the business can trend towards profitability and fund its growth, then the market could present an opportunity. But you might want to take a closer look at this one.

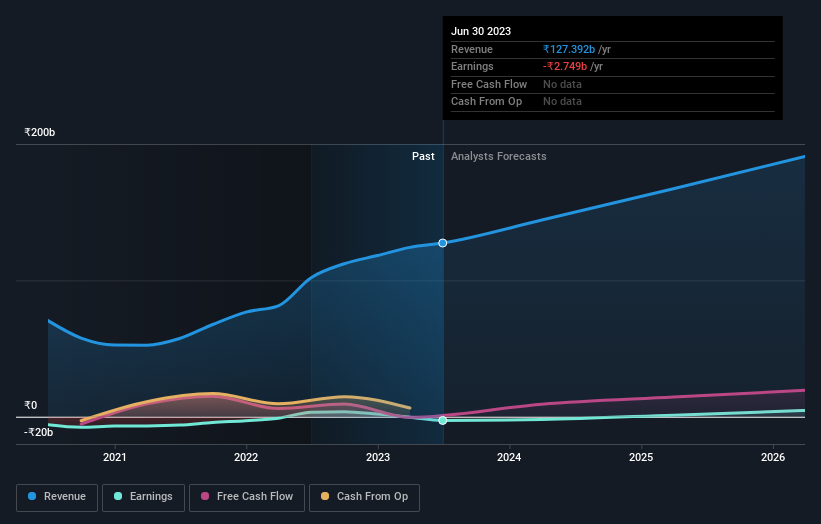

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Aditya Birla Fashion and Retail is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. Given we have quite a good number of analyst forecasts, it might be well worth checking out this free chart depicting consensus estimates.

A Different Perspective

Investors in Aditya Birla Fashion and Retail had a tough year, with a total loss of 30%, against a market gain of about 12%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. On the bright side, long term shareholders have made money, with a gain of 3% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Indian exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:ABFRL

Aditya Birla Fashion and Retail

Manufactures, distributes, and retails fashion apparel and accessories in India and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives