- India

- /

- Real Estate

- /

- NSEI:PROZONER

The Prozone Intu Properties (NSE:PROZONINTU) Share Price Is Down 60% So Some Shareholders Are Wishing They Sold

If you are building a properly diversified stock portfolio, the chances are some of your picks will perform badly. Long term Prozone Intu Properties Limited (NSE:PROZONINTU) shareholders know that all too well, since the share price is down considerably over three years. Unfortunately, they have held through a 60% decline in the share price in that time. And the ride hasn't got any smoother in recent times over the last year, with the price 47% lower in that time. On top of that, the share price has dropped a further 18% in a month.

View our latest analysis for Prozone Intu Properties

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

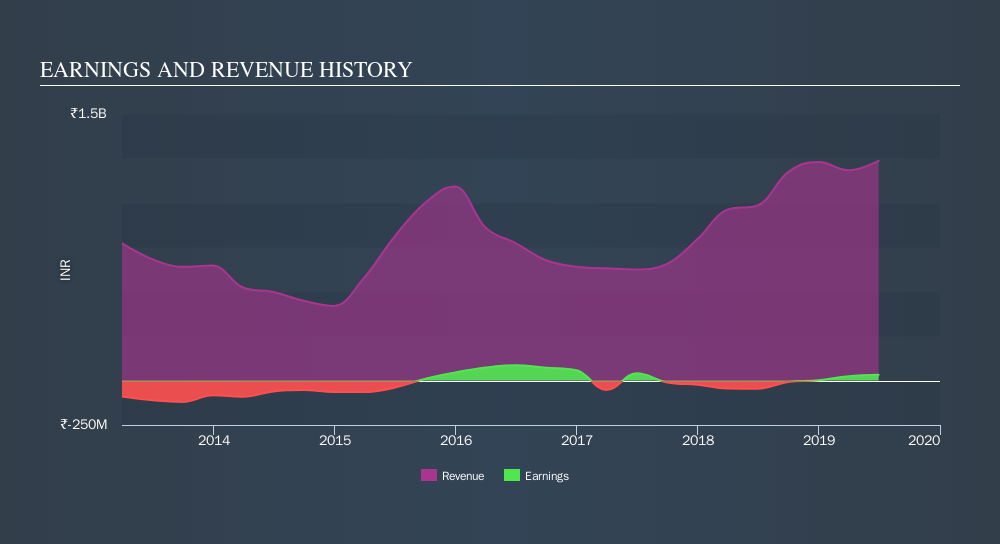

During five years of share price growth, Prozone Intu Properties moved from a loss to profitability. We would usually expect to see the share price rise as a result. So given the share price is down it's worth checking some other metrics too.

Revenue is actually up 25% over the three years, so the share price drop doesn't seem to hinge on revenue, either. It's probably worth investigating Prozone Intu Properties further; while we may be missing something on this analysis, there might also be an opportunity.

You can see below how revenue has changed over time.

This free interactive report on Prozone Intu Properties's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

Prozone Intu Properties shareholders are down 47% for the year, but the market itself is up 8.2%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 2.7% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. Most investors take the time to check the data on insider transactions. You can click here to see if insiders have been buying or selling.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NSEI:PROZONER

Prozone Realty

Designs, develops, owns, and operates shopping malls, and commercial and residential premises in India.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives