- India

- /

- Real Estate

- /

- NSEI:GODREJPROP

Does Godrej Properties (NSE:GODREJPROP) Have A Healthy Balance Sheet?

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about. So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. As with many other companies Godrej Properties Limited (NSE:GODREJPROP) makes use of debt. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for Godrej Properties

How Much Debt Does Godrej Properties Carry?

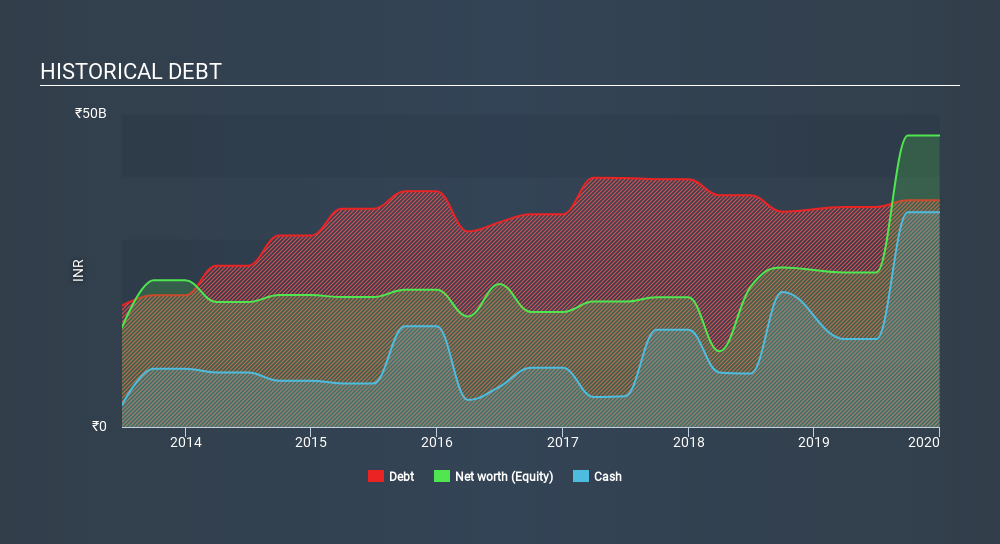

The chart below, which you can click on for greater detail, shows that Godrej Properties had ₹36.2b in debt in September 2019; about the same as the year before. However, it also had ₹34.3b in cash, and so its net debt is ₹1.93b.

How Strong Is Godrej Properties's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Godrej Properties had liabilities of ₹58.1b due within 12 months and liabilities of ₹166.6m due beyond that. Offsetting this, it had ₹34.3b in cash and ₹18.3b in receivables that were due within 12 months. So it has liabilities totalling ₹5.61b more than its cash and near-term receivables, combined.

Since publicly traded Godrej Properties shares are worth a total of ₹171.3b, it seems unlikely that this level of liabilities would be a major threat. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward. But either way, Godrej Properties has virtually no net debt, so it's fair to say it does not have a heavy debt load!

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Godrej Properties has a low debt to EBITDA ratio of only 0.32. And remarkably, despite having net debt, it actually received more in interest over the last twelve months than it had to pay. So there's no doubt this company can take on debt while staying cool as a cucumber. It was also good to see that despite losing money on the EBIT line last year, Godrej Properties turned things around in the last 12 months, delivering and EBIT of ₹5.9b. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if Godrej Properties can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So it is important to check how much of its earnings before interest and tax (EBIT) converts to actual free cash flow. Considering the last year, Godrej Properties actually recorded a cash outflow, overall. Debt is far more risky for companies with unreliable free cash flow, so shareholders should be hoping that the past expenditure will produce free cash flow in the future.

Our View

Both Godrej Properties's ability to to cover its interest expense with its EBIT and its net debt to EBITDA gave us comfort that it can handle its debt. But truth be told its conversion of EBIT to free cash flow had us nibbling our nails. Considering this range of data points, we think Godrej Properties is in a good position to manage its debt levels. But a word of caution: we think debt levels are high enough to justify ongoing monitoring. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. Case in point: We've spotted 4 warning signs for Godrej Properties you should be aware of, and 1 of them makes us a bit uncomfortable.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NSEI:GODREJPROP

Godrej Properties

Engages in the real estate construction, development, and other related activities in India.

High growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives