- India

- /

- Real Estate

- /

- NSEI:ANANTRAJ

Here's Why We Think Anant Raj (NSE:ANANTRAJ) Might Deserve Your Attention Today

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Anant Raj (NSE:ANANTRAJ). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

See our latest analysis for Anant Raj

Anant Raj's Improving Profits

Even when EPS earnings per share (EPS) growth is unexceptional, company value can be created if this rate is sustained each year. So EPS growth can certainly encourage an investor to take note of a stock. Outstandingly, Anant Raj's EPS shot from ₹1.42 to ₹3.90, over the last year. Year on year growth of 175% is certainly a sight to behold. Shareholders will be hopeful that this is a sign of the company reaching an inflection point.

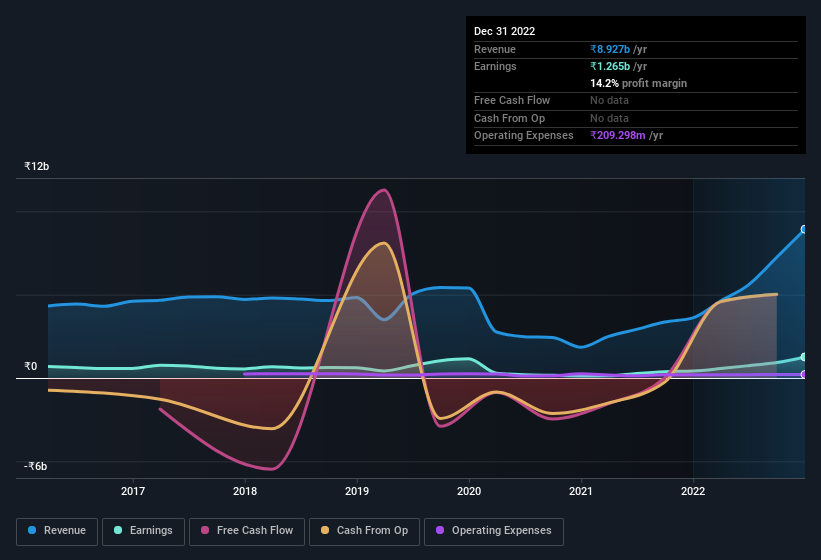

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Anant Raj maintained stable EBIT margins over the last year, all while growing revenue 147% to ₹8.9b. That's encouraging news for the company!

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

While profitability drives the upside, prudent investors always check the balance sheet, too.

Are Anant Raj Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

The good news is that Anant Raj insiders spent a whopping ₹102m on stock in just one year, without so much as a single sale. Knowing this, Anant Raj will have have all eyes on them in anticipation for the what could happen in the near future. It is also worth noting that it was CEO & Whole Time Director Aman Sarin who made the biggest single purchase, worth ₹23m, paying ₹114 per share.

These recent buys aren't the only encouraging sign for shareholders, as a look at the shareholder registry for Anant Raj will reveal that insiders own a significant piece of the pie. Indeed, with a collective holding of 61%, company insiders are in control and have plenty of capital behind the venture. This should be seen as a good thing, as it means insiders have a personal interest in delivering the best outcomes for shareholders. This is an incredible endorsement from them.

While insiders are apparently happy to hold and accumulate shares, that is just part of the big picture. That's because Anant Raj's CEO, Aman Sarin, is paid at a relatively modest level when compared to other CEOs for companies of this size. The median total compensation for CEOs of companies similar in size to Anant Raj, with market caps between ₹17b and ₹66b, is around ₹25m.

The Anant Raj CEO received total compensation of just ₹9.0m in the year to March 2022. That looks like a modest pay packet, and may hint at a certain respect for the interests of shareholders. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Does Anant Raj Deserve A Spot On Your Watchlist?

Anant Raj's earnings per share have been soaring, with growth rates sky high. Just as heartening; insiders both own and are buying more stock. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe Anant Raj deserves timely attention. What about risks? Every company has them, and we've spotted 1 warning sign for Anant Raj you should know about.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Anant Raj, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:ANANTRAJ

Anant Raj

Primarily engaged in the real estate and infrastructure development business in India.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026