- India

- /

- Real Estate

- /

- NSEI:TEXINFRA

Texmaco Infrastructure & Holdings Limited's (NSE:TEXINFRA) stock price dropped 14% last week; public companies would not be happy

Key Insights

- The considerable ownership by public companies in Texmaco Infrastructure & Holdings indicates that they collectively have a greater say in management and business strategy

- A total of 3 investors have a majority stake in the company with 55% ownership

- 16% of Texmaco Infrastructure & Holdings is held by insiders

A look at the shareholders of Texmaco Infrastructure & Holdings Limited (NSE:TEXINFRA) can tell us which group is most powerful. The group holding the most number of shares in the company, around 32% to be precise, is public companies. Put another way, the group faces the maximum upside potential (or downside risk).

As a result, public companies as a group endured the highest losses last week after market cap fell by ₹2.5b.

In the chart below, we zoom in on the different ownership groups of Texmaco Infrastructure & Holdings.

View our latest analysis for Texmaco Infrastructure & Holdings

What Does The Institutional Ownership Tell Us About Texmaco Infrastructure & Holdings?

Many institutions measure their performance against an index that approximates the local market. So they usually pay more attention to companies that are included in major indices.

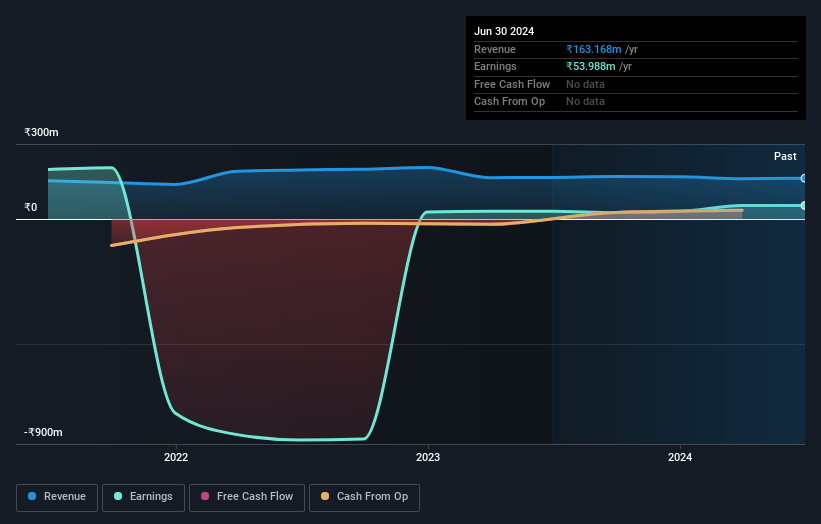

Texmaco Infrastructure & Holdings already has institutions on the share registry. Indeed, they own a respectable stake in the company. This can indicate that the company has a certain degree of credibility in the investment community. However, it is best to be wary of relying on the supposed validation that comes with institutional investors. They too, get it wrong sometimes. When multiple institutions own a stock, there's always a risk that they are in a 'crowded trade'. When such a trade goes wrong, multiple parties may compete to sell stock fast. This risk is higher in a company without a history of growth. You can see Texmaco Infrastructure & Holdings' historic earnings and revenue below, but keep in mind there's always more to the story.

Hedge funds don't have many shares in Texmaco Infrastructure & Holdings. The company's largest shareholder is Zuari Industries Limited, with ownership of 31%. With 16% and 6.9% of the shares outstanding respectively, Adventz Finance Private Limited and Hardik Patel are the second and third largest shareholders.

A more detailed study of the shareholder registry showed us that 3 of the top shareholders have a considerable amount of ownership in the company, via their 55% stake.

While studying institutional ownership for a company can add value to your research, it is also a good practice to research analyst recommendations to get a deeper understand of a stock's expected performance. We're not picking up on any analyst coverage of the stock at the moment, so the company is unlikely to be widely held.

Insider Ownership Of Texmaco Infrastructure & Holdings

The definition of an insider can differ slightly between different countries, but members of the board of directors always count. The company management answer to the board and the latter should represent the interests of shareholders. Notably, sometimes top-level managers are on the board themselves.

Insider ownership is positive when it signals leadership are thinking like the true owners of the company. However, high insider ownership can also give immense power to a small group within the company. This can be negative in some circumstances.

Our information suggests that insiders maintain a significant holding in Texmaco Infrastructure & Holdings Limited. It has a market capitalization of just ₹16b, and insiders have ₹2.4b worth of shares in their own names. We would say this shows alignment with shareholders, but it is worth noting that the company is still quite small; some insiders may have founded the business. You can click here to see if those insiders have been buying or selling.

General Public Ownership

With a 16% ownership, the general public, mostly comprising of individual investors, have some degree of sway over Texmaco Infrastructure & Holdings. While this group can't necessarily call the shots, it can certainly have a real influence on how the company is run.

Private Company Ownership

Our data indicates that Private Companies hold 29%, of the company's shares. It might be worth looking deeper into this. If related parties, such as insiders, have an interest in one of these private companies, that should be disclosed in the annual report. Private companies may also have a strategic interest in the company.

Public Company Ownership

We can see that public companies hold 32% of the Texmaco Infrastructure & Holdings shares on issue. This may be a strategic interest and the two companies may have related business interests. It could be that they have de-merged. This holding is probably worth investigating further.

Next Steps:

It's always worth thinking about the different groups who own shares in a company. But to understand Texmaco Infrastructure & Holdings better, we need to consider many other factors. For instance, we've identified 2 warning signs for Texmaco Infrastructure & Holdings that you should be aware of.

If you would prefer check out another company -- one with potentially superior financials -- then do not miss this free list of interesting companies, backed by strong financial data.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Texmaco Infrastructure & Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:TEXINFRA

Texmaco Infrastructure & Holdings

Engages in the business of real estate, hydro power generation, and job work services in India.

Good value with adequate balance sheet.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion