- India

- /

- Real Estate

- /

- NSEI:PURVA

After Leaping 27% Puravankara Limited (NSE:PURVA) Shares Are Not Flying Under The Radar

Despite an already strong run, Puravankara Limited (NSE:PURVA) shares have been powering on, with a gain of 27% in the last thirty days. This latest share price bounce rounds out a remarkable 449% gain over the last twelve months.

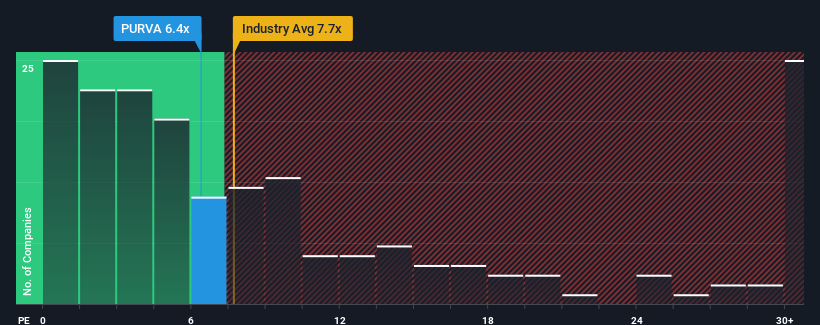

Even after such a large jump in price, it's still not a stretch to say that Puravankara's price-to-sales (or "P/S") ratio of 6.4x right now seems quite "middle-of-the-road" compared to the Real Estate industry in India, where the median P/S ratio is around 7.7x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for Puravankara

What Does Puravankara's Recent Performance Look Like?

With revenue growth that's inferior to most other companies of late, Puravankara has been relatively sluggish. One possibility is that the P/S ratio is moderate because investors think this lacklustre revenue performance will turn around. If not, then existing shareholders may be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Puravankara.Is There Some Revenue Growth Forecasted For Puravankara?

Puravankara's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Taking a look back first, we see that the company grew revenue by an impressive 47% last year. The strong recent performance means it was also able to grow revenue by 64% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the sole analyst covering the company suggest revenue should grow by 36% over the next year. That's shaping up to be similar to the 37% growth forecast for the broader industry.

With this information, we can see why Puravankara is trading at a fairly similar P/S to the industry. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

The Final Word

Puravankara appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

A Puravankara's P/S seems about right to us given the knowledge that analysts are forecasting a revenue outlook that is similar to the Real Estate industry. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. Unless these conditions change, they will continue to support the share price at these levels.

And what about other risks? Every company has them, and we've spotted 5 warning signs for Puravankara (of which 3 are significant!) you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:PURVA

Puravankara

Designs, develops, constructs, and markets residential and commercial properties in India.

Undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives