- India

- /

- Real Estate

- /

- NSEI:PENINLAND

Peninsula Land Limited's (NSE:PENINLAND) Price Is Right But Growth Is Lacking After Shares Rocket 26%

Peninsula Land Limited (NSE:PENINLAND) shares have continued their recent momentum with a 26% gain in the last month alone. But the last month did very little to improve the 50% share price decline over the last year.

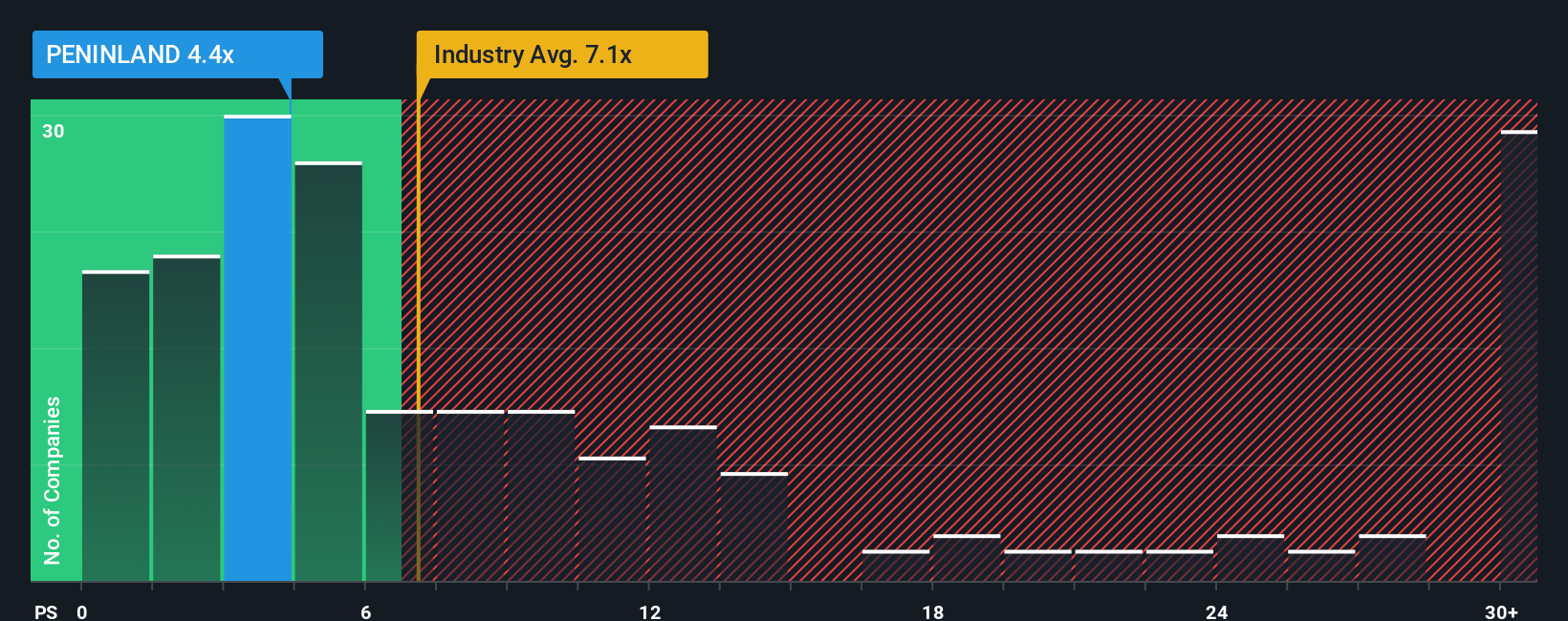

In spite of the firm bounce in price, Peninsula Land may still be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 4.4x, since almost half of all companies in the Real Estate industry in India have P/S ratios greater than 7.1x and even P/S higher than 15x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for Peninsula Land

What Does Peninsula Land's Recent Performance Look Like?

For instance, Peninsula Land's receding revenue in recent times would have to be some food for thought. Perhaps the market believes the recent revenue performance isn't good enough to keep up the industry, causing the P/S ratio to suffer. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Peninsula Land's earnings, revenue and cash flow.Do Revenue Forecasts Match The Low P/S Ratio?

In order to justify its P/S ratio, Peninsula Land would need to produce sluggish growth that's trailing the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 55%. As a result, revenue from three years ago have also fallen 41% overall. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 45% shows it's an unpleasant look.

In light of this, it's understandable that Peninsula Land's P/S would sit below the majority of other companies. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Bottom Line On Peninsula Land's P/S

The latest share price surge wasn't enough to lift Peninsula Land's P/S close to the industry median. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Peninsula Land revealed its shrinking revenue over the medium-term is contributing to its low P/S, given the industry is set to grow. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. If recent medium-term revenue trends continue, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

A lot of potential risks can sit within a company's balance sheet. Our free balance sheet analysis for Peninsula Land with six simple checks will allow you to discover any risks that could be an issue.

If you're unsure about the strength of Peninsula Land's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:PENINLAND

Peninsula Land

Through its subsidiaries, engages in the real estate development activities in India.

Mediocre balance sheet and slightly overvalued.

Market Insights

Community Narratives