- India

- /

- Real Estate

- /

- NSEI:OSWALGREEN

Oswal Greentech Limited's (NSE:OSWALGREEN) stock price dropped 11% last week; public companies would not be happy

Key Insights

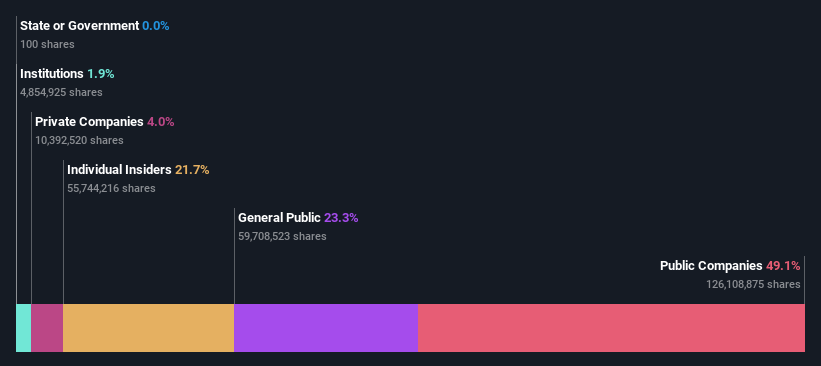

- The considerable ownership by public companies in Oswal Greentech indicates that they collectively have a greater say in management and business strategy

- A total of 2 investors have a majority stake in the company with 69% ownership

- Insider ownership in Oswal Greentech is 22%

If you want to know who really controls Oswal Greentech Limited (NSE:OSWALGREEN), then you'll have to look at the makeup of its share registry. We can see that public companies own the lion's share in the company with 49% ownership. That is, the group stands to benefit the most if the stock rises (or lose the most if there is a downturn).

As market cap fell to ₹8.7b last week, public companies would have faced the highest losses than any other shareholder groups of the company.

In the chart below, we zoom in on the different ownership groups of Oswal Greentech.

View our latest analysis for Oswal Greentech

What Does The Institutional Ownership Tell Us About Oswal Greentech?

Many institutions measure their performance against an index that approximates the local market. So they usually pay more attention to companies that are included in major indices.

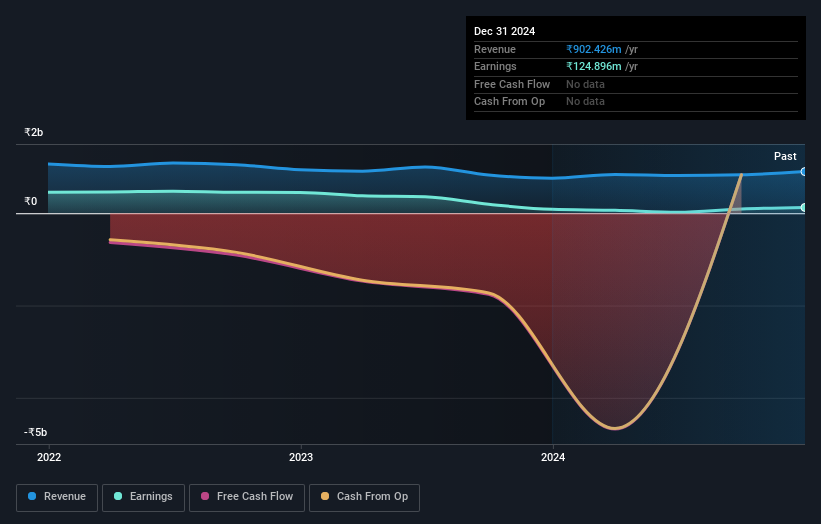

Since institutions own only a small portion of Oswal Greentech, many may not have spent much time considering the stock. But it's clear that some have; and they liked it enough to buy in. If the company is growing earnings, that may indicate that it is just beginning to catch the attention of these deep-pocketed investors. We sometimes see a rising share price when a few big institutions want to buy a certain stock at the same time. The history of earnings and revenue, which you can see below, could be helpful in considering if more institutional investors will want the stock. Of course, there are plenty of other factors to consider, too.

We note that hedge funds don't have a meaningful investment in Oswal Greentech. Looking at our data, we can see that the largest shareholder is Oswal Agro Mills Limited with 49% of shares outstanding. With 20% and 1.9% of the shares outstanding respectively, Aruna Oswal and Bhavani Techno Projects Ltd, Asset Management Arm are the second and third largest shareholders. Aruna Oswal, who is the second-largest shareholder, also happens to hold the title of Top Key Executive.

A more detailed study of the shareholder registry showed us that 2 of the top shareholders have a considerable amount of ownership in the company, via their 69% stake.

Researching institutional ownership is a good way to gauge and filter a stock's expected performance. The same can be achieved by studying analyst sentiments. As far as we can tell there isn't analyst coverage of the company, so it is probably flying under the radar.

Insider Ownership Of Oswal Greentech

While the precise definition of an insider can be subjective, almost everyone considers board members to be insiders. Company management run the business, but the CEO will answer to the board, even if he or she is a member of it.

Insider ownership is positive when it signals leadership are thinking like the true owners of the company. However, high insider ownership can also give immense power to a small group within the company. This can be negative in some circumstances.

It seems insiders own a significant proportion of Oswal Greentech Limited. It has a market capitalization of just ₹8.7b, and insiders have ₹1.9b worth of shares in their own names. This may suggest that the founders still own a lot of shares. You can click here to see if they have been buying or selling.

General Public Ownership

The general public-- including retail investors -- own 23% stake in the company, and hence can't easily be ignored. This size of ownership, while considerable, may not be enough to change company policy if the decision is not in sync with other large shareholders.

Private Company Ownership

It seems that Private Companies own 4.0%, of the Oswal Greentech stock. Private companies may be related parties. Sometimes insiders have an interest in a public company through a holding in a private company, rather than in their own capacity as an individual. While it's hard to draw any broad stroke conclusions, it is worth noting as an area for further research.

Public Company Ownership

We can see that public companies hold 49% of the Oswal Greentech shares on issue. This may be a strategic interest and the two companies may have related business interests. It could be that they have de-merged. This holding is probably worth investigating further.

Next Steps:

It's always worth thinking about the different groups who own shares in a company. But to understand Oswal Greentech better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with Oswal Greentech (at least 1 which makes us a bit uncomfortable) , and understanding them should be part of your investment process.

If you would prefer check out another company -- one with potentially superior financials -- then do not miss this free list of interesting companies, backed by strong financial data.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:OSWALGREEN

Flawless balance sheet with acceptable track record.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion