- India

- /

- Real Estate

- /

- NSEI:MAHLIFE

Mahindra Lifespace Developers (NSE:MAHLIFE) Has Announced That It Will Be Increasing Its Dividend To ₹2.30

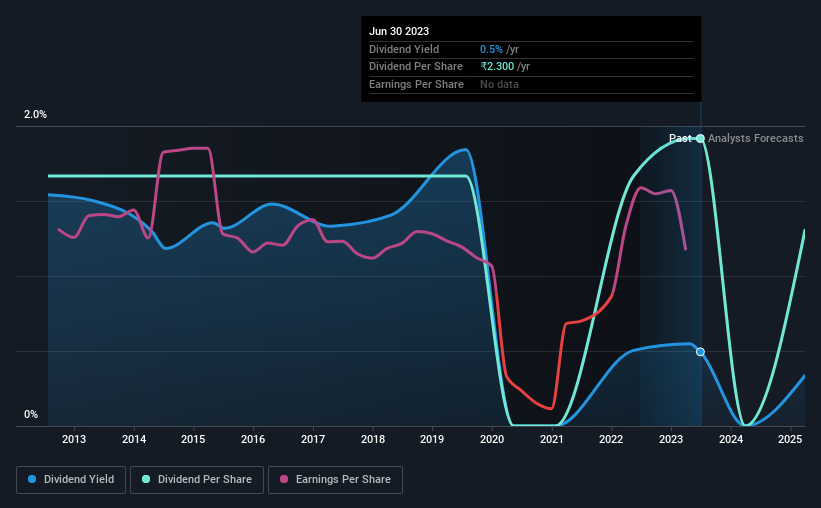

Mahindra Lifespace Developers Limited (NSE:MAHLIFE) has announced that it will be increasing its dividend from last year's comparable payment on the 25th of August to ₹2.30. This takes the annual payment to 0.5% of the current stock price, which unfortunately is below what the industry is paying.

While the dividend yield is important for income investors, it is also important to consider any large share price moves, as this will generally outweigh any gains from distributions. Investors will be pleased to see that Mahindra Lifespace Developers' stock price has increased by 32% in the last 3 months, which is good for shareholders and can also explain a decrease in the dividend yield.

See our latest analysis for Mahindra Lifespace Developers

Mahindra Lifespace Developers' Dividend Is Well Covered By Earnings

It would be nice for the yield to be higher, but we should also check if higher levels of dividend payment would be sustainable. Based on the last payment, Mahindra Lifespace Developers was earning enough to cover the dividend, but free cash flows weren't positive. We think that cash flows should take priority over earnings, so this is definitely a worry for the dividend going forward.

Over the next year, EPS is forecast to expand by 129.7%. If the dividend continues on this path, the payout ratio could be 15% by next year, which we think can be pretty sustainable going forward.

Dividend Volatility

The company's dividend history has been marked by instability, with at least one cut in the last 10 years. The dividend has gone from an annual total of ₹2.00 in 2013 to the most recent total annual payment of ₹2.30. This works out to be a compound annual growth rate (CAGR) of approximately 1.4% a year over that time. Modest growth in the dividend is good to see, but we think this is offset by historical cuts to the payments. It is hard to live on a dividend income if the company's earnings are not consistent.

Mahindra Lifespace Developers May Find It Hard To Grow The Dividend

Given that the dividend has been cut in the past, we need to check if earnings are growing and if that might lead to stronger dividends in the future. However, Mahindra Lifespace Developers' EPS was effectively flat over the past five years, which could stop the company from paying more every year.

The Dividend Could Prove To Be Unreliable

In summary, while it's always good to see the dividend being raised, we don't think Mahindra Lifespace Developers' payments are rock solid. While Mahindra Lifespace Developers is earning enough to cover the payments, the cash flows are lacking. Overall, we don't think this company has the makings of a good income stock.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. For instance, we've picked out 4 warning signs for Mahindra Lifespace Developers that investors should take into consideration. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:MAHLIFE

Mahindra Lifespace Developers

Engages in the real estate and infrastructure development business in India.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Positioned to Win as the Streaming Wars Settle

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion