- India

- /

- Real Estate

- /

- NSEI:LODHA

Just Four Days Till Macrotech Developers Limited (NSE:LODHA) Will Be Trading Ex-Dividend

Regular readers will know that we love our dividends at Simply Wall St, which is why it's exciting to see Macrotech Developers Limited (NSE:LODHA) is about to trade ex-dividend in the next four days. The ex-dividend date is one business day before the record date, which is the cut-off date for shareholders to be present on the company's books to be eligible for a dividend payment. The ex-dividend date is important as the process of settlement involves two full business days. So if you miss that date, you would not show up on the company's books on the record date. Accordingly, Macrotech Developers investors that purchase the stock on or after the 16th of August will not receive the dividend, which will be paid on the 22nd of September.

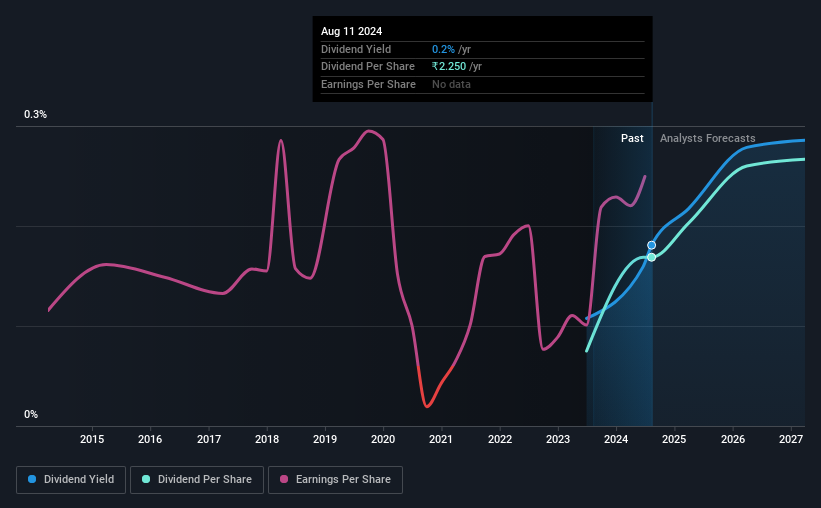

The company's next dividend payment will be ₹2.25 per share, and in the last 12 months, the company paid a total of ₹2.25 per share. Looking at the last 12 months of distributions, Macrotech Developers has a trailing yield of approximately 0.2% on its current stock price of ₹1244.35. We love seeing companies pay a dividend, but it's also important to be sure that laying the golden eggs isn't going to kill our golden goose! We need to see whether the dividend is covered by earnings and if it's growing.

View our latest analysis for Macrotech Developers

Dividends are typically paid out of company income, so if a company pays out more than it earned, its dividend is usually at a higher risk of being cut. Macrotech Developers has a low and conservative payout ratio of just 14% of its income after tax. Yet cash flows are even more important than profits for assessing a dividend, so we need to see if the company generated enough cash to pay its distribution. It paid out 4.1% of its free cash flow as dividends last year, which is conservatively low.

It's encouraging to see that the dividend is covered by both profit and cash flow. This generally suggests the dividend is sustainable, as long as earnings don't drop precipitously.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

When earnings decline, dividend companies become much harder to analyse and own safely. If earnings fall far enough, the company could be forced to cut its dividend. That's why it's not ideal to see Macrotech Developers's earnings per share have been shrinking at 2.1% a year over the previous five years.

Unfortunately Macrotech Developers has only been paying a dividend for a year or so, so there's not much of a history to draw insight from.

Final Takeaway

Should investors buy Macrotech Developers for the upcoming dividend? Macrotech Developers has comfortably low cash and profit payout ratios, which may mean the dividend is sustainable even in the face of a sharp decline in earnings per share. Still, we consider declining earnings to be a warning sign. In summary, while it has some positive characteristics, we're not inclined to race out and buy Macrotech Developers today.

In light of that, while Macrotech Developers has an appealing dividend, it's worth knowing the risks involved with this stock. Every company has risks, and we've spotted 1 warning sign for Macrotech Developers you should know about.

Generally, we wouldn't recommend just buying the first dividend stock you see. Here's a curated list of interesting stocks that are strong dividend payers.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:LODHA

Lodha Developers

Through its subsidiaries, engages in the development of real estate properties in India.

Solid track record with excellent balance sheet.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion