- India

- /

- Real Estate

- /

- NSEI:LODHA

This Is The Reason Why We Think Lodha Developers Limited's (NSE:LODHA) CEO Might Be Underpaid

Key Insights

- Lodha Developers will host its Annual General Meeting on 29th of August

- Salary of ₹49.5m is part of CEO Abhishek Mangal Lodha's total remuneration

- Total compensation is 55% below industry average

- Over the past three years, Lodha Developers' EPS grew by 28% and over the past three years, the total shareholder return was 140%

The solid performance at Lodha Developers Limited (NSE:LODHA) has been impressive and shareholders will probably be pleased to know that CEO Abhishek Mangal Lodha has delivered. This would be kept in mind at the upcoming AGM on 29th of August which will be a chance for them to hear the board review the financial results, discuss future company strategy and vote on resolutions such as executive remuneration and other matters. Let's take a look at why we think the CEO has done a good job and we'll present the case for a bump in pay.

See our latest analysis for Lodha Developers

Comparing Lodha Developers Limited's CEO Compensation With The Industry

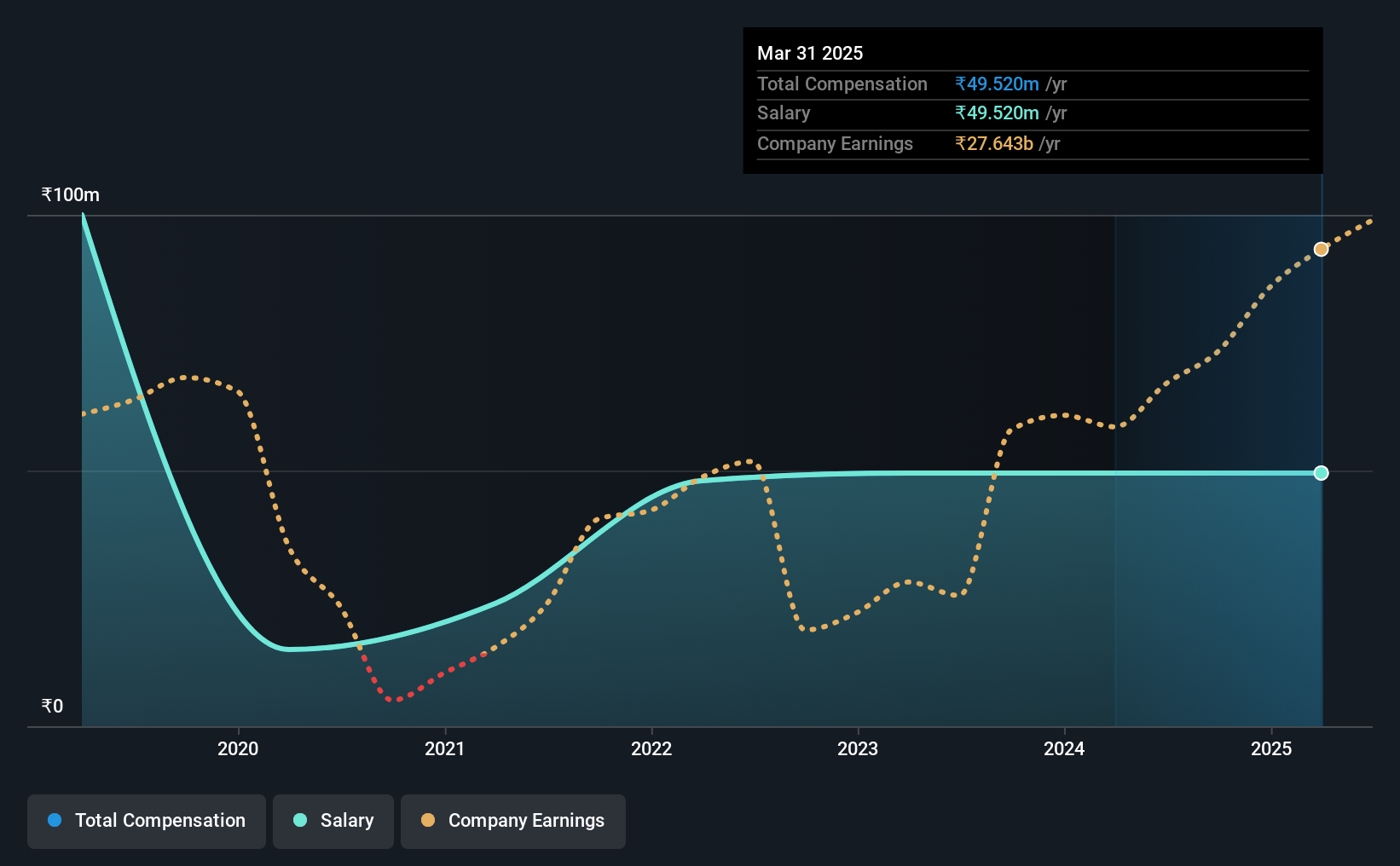

According to our data, Lodha Developers Limited has a market capitalization of ₹1.3t, and paid its CEO total annual compensation worth ₹50m over the year to March 2025. That is, the compensation was roughly the same as last year. Notably, the salary of ₹50m is the entirety of the CEO compensation.

In comparison with other companies in the Indian Real Estate industry with market capitalizations over ₹700b, the reported median total CEO compensation was ₹109m. In other words, Lodha Developers pays its CEO lower than the industry median. Moreover, Abhishek Mangal Lodha also holds ₹291b worth of Lodha Developers stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2025 | 2024 | Proportion (2025) |

| Salary | ₹50m | ₹50m | 100% |

| Other | - | - | - |

| Total Compensation | ₹50m | ₹50m | 100% |

Speaking on an industry level, all of total compensation represents salary, while non-salary remuneration is completely ignored. On a company level, Lodha Developers prefers to reward its CEO through a salary, opting not to pay Abhishek Mangal Lodha through non-salary benefits. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

Lodha Developers Limited's Growth

Lodha Developers Limited has seen its earnings per share (EPS) increase by 28% a year over the past three years. Its revenue is up 25% over the last year.

This demonstrates that the company has been improving recently and is good news for the shareholders. The combination of strong revenue growth with medium-term EPS improvement certainly points to the kind of growth we like to see. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Lodha Developers Limited Been A Good Investment?

Boasting a total shareholder return of 140% over three years, Lodha Developers Limited has done well by shareholders. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

In Summary...

Lodha Developers pays CEO compensation exclusively through a salary, with non-salary compensation completely ignored. The company's solid performance might have made most shareholders happy, possibly making CEO remuneration the least of the matters to be discussed in the AGM. In fact, strategic decisions that could impact the future of the business might be a far more interesting topic for investors as it would help them set their longer-term expectations.

Whatever your view on compensation, you might want to check if insiders are buying or selling Lodha Developers shares (free trial).

Switching gears from Lodha Developers, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:LODHA

Lodha Developers

Through its subsidiaries, engages in the development of real estate properties in India.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026