- India

- /

- Real Estate

- /

- NSEI:DBREALTY

D B Realty Limited's (NSE:DBREALTY) Price Is Right But Growth Is Lacking After Shares Rocket 30%

Those holding D B Realty Limited (NSE:DBREALTY) shares would be relieved that the share price has rebounded 30% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 8.4% over the last year.

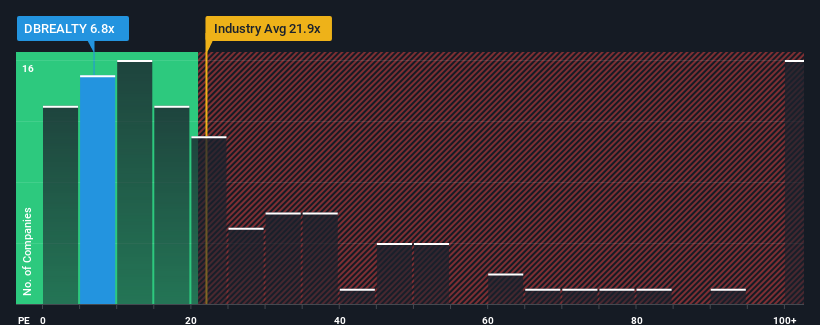

Although its price has surged higher, D B Realty may still be sending very bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 6.8x, since almost half of all companies in India have P/E ratios greater than 22x and even P/E's higher than 45x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

We'd have to say that with no tangible growth over the last year, D B Realty's earnings have been unimpressive. One possibility is that the P/E is low because investors think this benign earnings growth rate will likely underperform the broader market in the near future. If not, then existing shareholders may be feeling optimistic about the future direction of the share price.

See our latest analysis for D B Realty

How Is D B Realty's Growth Trending?

There's an inherent assumption that a company should far underperform the market for P/E ratios like D B Realty's to be considered reasonable.

Retrospectively, the last year delivered virtually the same number to the company's bottom line as the year before. The longer-term trend has been no better as the company has no earnings growth to show for over the last three years either. Accordingly, shareholders probably wouldn't have been satisfied with the complete absence of medium-term growth.

This is in contrast to the rest of the market, which is expected to grow by 24% over the next year, materially higher than the company's recent medium-term annualised growth rates.

In light of this, it's understandable that D B Realty's P/E sits below the majority of other companies. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

The Final Word

Even after such a strong price move, D B Realty's P/E still trails the rest of the market significantly. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of D B Realty revealed its three-year earnings trends are contributing to its low P/E, given they look worse than current market expectations. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

Before you settle on your opinion, we've discovered 4 warning signs for D B Realty (2 don't sit too well with us!) that you should be aware of.

Of course, you might also be able to find a better stock than D B Realty. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:DBREALTY

Valor Estate

Operates as a real estate construction and development company in India.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives