- India

- /

- Real Estate

- /

- NSEI:ARIHANTSUP

Does Arihant Superstructures (NSE:ARIHANTSUP) Have A Healthy Balance Sheet?

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We can see that Arihant Superstructures Limited (NSE:ARIHANTSUP) does use debt in its business. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we examine debt levels, we first consider both cash and debt levels, together.

What Is Arihant Superstructures's Net Debt?

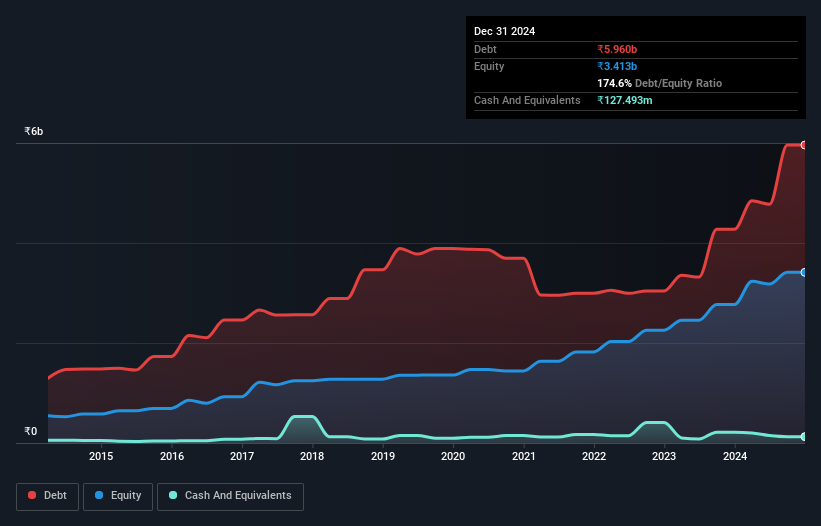

As you can see below, at the end of September 2024, Arihant Superstructures had ₹5.96b of debt, up from ₹4.27b a year ago. Click the image for more detail. On the flip side, it has ₹127.5m in cash leading to net debt of about ₹5.83b.

How Healthy Is Arihant Superstructures' Balance Sheet?

According to the last reported balance sheet, Arihant Superstructures had liabilities of ₹5.10b due within 12 months, and liabilities of ₹5.27b due beyond 12 months. On the other hand, it had cash of ₹127.5m and ₹1.14b worth of receivables due within a year. So it has liabilities totalling ₹9.10b more than its cash and near-term receivables, combined.

Arihant Superstructures has a market capitalization of ₹17.0b, so it could very likely raise cash to ameliorate its balance sheet, if the need arose. But we definitely want to keep our eyes open to indications that its debt is bringing too much risk.

View our latest analysis for Arihant Superstructures

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

With a net debt to EBITDA ratio of 5.2, it's fair to say Arihant Superstructures does have a significant amount of debt. But the good news is that it boasts fairly comforting interest cover of 4.1 times, suggesting it can responsibly service its obligations. On a lighter note, we note that Arihant Superstructures grew its EBIT by 28% in the last year. If sustained, this growth should make that debt evaporate like a scarce drinking water during an unnaturally hot summer. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since Arihant Superstructures will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. Over the last three years, Arihant Superstructures saw substantial negative free cash flow, in total. While that may be a result of expenditure for growth, it does make the debt far more risky.

Our View

Both Arihant Superstructures's conversion of EBIT to free cash flow and its net debt to EBITDA were discouraging. But on the brighter side of life, its EBIT growth rate leaves us feeling more frolicsome. When we consider all the factors discussed, it seems to us that Arihant Superstructures is taking some risks with its use of debt. So while that leverage does boost returns on equity, we wouldn't really want to see it increase from here. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. We've identified 2 warning signs with Arihant Superstructures (at least 1 which is potentially serious) , and understanding them should be part of your investment process.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:ARIHANTSUP

Arihant Superstructures

Operates as a real estate development company in India.

Acceptable track record with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026