It's A Story Of Risk Vs Reward With Unichem Laboratories Limited (NSE:UNICHEMLAB)

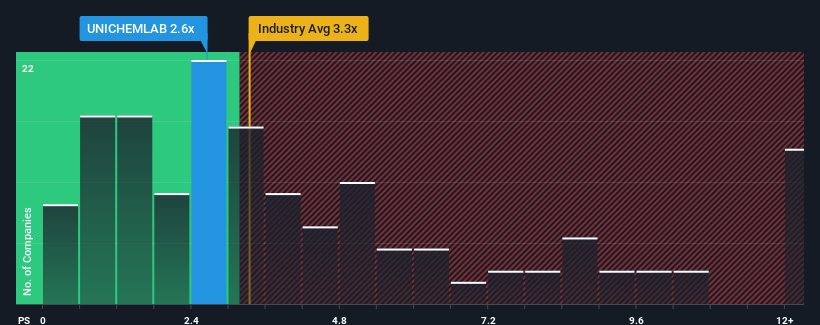

Unichem Laboratories Limited's (NSE:UNICHEMLAB) price-to-sales (or "P/S") ratio of 2.6x might make it look like a buy right now compared to the Pharmaceuticals industry in India, where around half of the companies have P/S ratios above 3.3x and even P/S above 7x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for Unichem Laboratories

How Unichem Laboratories Has Been Performing

Unichem Laboratories has been doing a good job lately as it's been growing revenue at a solid pace. Perhaps the market is expecting this acceptable revenue performance to take a dive, which has kept the P/S suppressed. If that doesn't eventuate, then existing shareholders have reason to be optimistic about the future direction of the share price.

Although there are no analyst estimates available for Unichem Laboratories, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The Low P/S?

Unichem Laboratories' P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Taking a look back first, we see that the company grew revenue by an impressive 19% last year. The latest three year period has also seen an excellent 42% overall rise in revenue, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing revenue over that time.

It's interesting to note that the rest of the industry is similarly expected to grow by 13% over the next year, which is fairly even with the company's recent medium-term annualised growth rates.

In light of this, it's peculiar that Unichem Laboratories' P/S sits below the majority of other companies. It may be that most investors are not convinced the company can maintain recent growth rates.

The Bottom Line On Unichem Laboratories' P/S

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

The fact that Unichem Laboratories currently trades at a low P/S relative to the industry is unexpected considering its recent three-year growth is in line with the wider industry forecast. There could be some unobserved threats to revenue preventing the P/S ratio from matching the company's performance. While recent

We don't want to rain on the parade too much, but we did also find 1 warning sign for Unichem Laboratories that you need to be mindful of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:UNICHEMLAB

Unichem Laboratories

A pharmaceutical company, manufactures and sells pharmaceutical products in India, the United States, and internationally.

Adequate balance sheet with questionable track record.

Similar Companies

Market Insights

Community Narratives