Over the last 7 days, the Indian market has experienced a 2.1% decline, yet it boasts a remarkable 42% increase over the past year with earnings anticipated to grow by 17% annually. In this context of fluctuating short-term performance and strong long-term growth prospects, identifying stocks that are estimated to be below their fair value can offer investors potential opportunities for capitalizing on future market gains.

Top 10 Undervalued Stocks Based On Cash Flows In India

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Everest Kanto Cylinder (NSEI:EKC) | ₹180.70 | ₹311.05 | 41.9% |

| Sudarshan Chemical Industries (BSE:506655) | ₹960.30 | ₹1828.85 | 47.5% |

| Titagarh Rail Systems (NSEI:TITAGARH) | ₹1092.55 | ₹2143.47 | 49% |

| RITES (NSEI:RITES) | ₹290.05 | ₹517.90 | 44% |

| IOL Chemicals and Pharmaceuticals (BSE:524164) | ₹391.65 | ₹762.32 | 48.6% |

| Vedanta (NSEI:VEDL) | ₹460.75 | ₹897.40 | 48.7% |

| Patel Engineering (BSE:531120) | ₹51.10 | ₹90.46 | 43.5% |

| Tarsons Products (NSEI:TARSONS) | ₹403.60 | ₹706.74 | 42.9% |

| Manorama Industries (BSE:541974) | ₹921.80 | ₹1665.51 | 44.7% |

| Strides Pharma Science (NSEI:STAR) | ₹1553.75 | ₹2704.30 | 42.5% |

Let's review some notable picks from our screened stocks.

Blue Jet Healthcare (NSEI:BLUEJET)

Overview: Blue Jet Healthcare Limited specializes in manufacturing and selling pharmaceutical intermediates and active pharmaceutical ingredients (APIs) for the pharmaceutical and healthcare sectors, with a market cap of ₹82.32 billion.

Operations: The company's revenue is primarily derived from its manufacturing of pharmaceutical and healthcare products, totaling ₹6.95 billion.

Estimated Discount To Fair Value: 12%

Blue Jet Healthcare appears undervalued based on cash flows, trading at ₹474.55 below its estimated fair value of ₹539.42. Despite a recent decline in quarterly revenue and net income, the company is expected to achieve significant earnings growth of 23.9% annually, outpacing the Indian market's average. Additionally, Blue Jet's inclusion in the S&P Global BMI Index highlights its potential appeal to investors seeking growth opportunities within India's healthcare sector.

- Our earnings growth report unveils the potential for significant increases in Blue Jet Healthcare's future results.

- Click here and access our complete balance sheet health report to understand the dynamics of Blue Jet Healthcare.

Quess (NSEI:QUESS)

Overview: Quess Corp Limited is a business services provider operating in India, South East Asia, the Middle East, and North America with a market cap of ₹103.60 billion.

Operations: The company generates revenue through several segments: Product Led Business at ₹4.29 billion, Workforce Management at ₹138.44 billion, Operating Asset Management at ₹28.43 billion, and Global Technology Solutions (excluding Product Led Business) at ₹23.87 billion.

Estimated Discount To Fair Value: 34.6%

Quess Corp is trading at ₹697.05, significantly below its estimated fair value of ₹1,065.78, indicating it may be undervalued based on cash flows. The company reported strong earnings growth of 62.5% over the past year and is forecasted to continue growing earnings at 22.9% annually, surpassing the Indian market's average growth rate. However, Quess has an unstable dividend track record and a low forecasted return on equity of 19.5% in three years.

- Our expertly prepared growth report on Quess implies its future financial outlook may be stronger than recent results.

- Delve into the full analysis health report here for a deeper understanding of Quess.

Tarsons Products (NSEI:TARSONS)

Overview: Tarsons Products Limited manufactures and trades scientific plastic labware products in India and internationally, with a market cap of ₹21.47 billion.

Operations: The company's revenue segment consists of Plastic Laboratory Products and Certain Scientific Instruments, amounting to ₹3.19 billion.

Estimated Discount To Fair Value: 42.9%

Tarsons Products is trading at ₹403.6, considerably below its estimated fair value of ₹706.74, suggesting potential undervaluation based on cash flows. Despite high debt levels and a recent GST-related penalty, the company is expected to achieve significant annual earnings growth of 27.5%, outpacing the Indian market average. However, profit margins have declined from last year, and its return on equity forecast remains low at 11.8% in three years.

- Our growth report here indicates Tarsons Products may be poised for an improving outlook.

- Click here to discover the nuances of Tarsons Products with our detailed financial health report.

Where To Now?

- Click through to start exploring the rest of the 30 Undervalued Indian Stocks Based On Cash Flows now.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

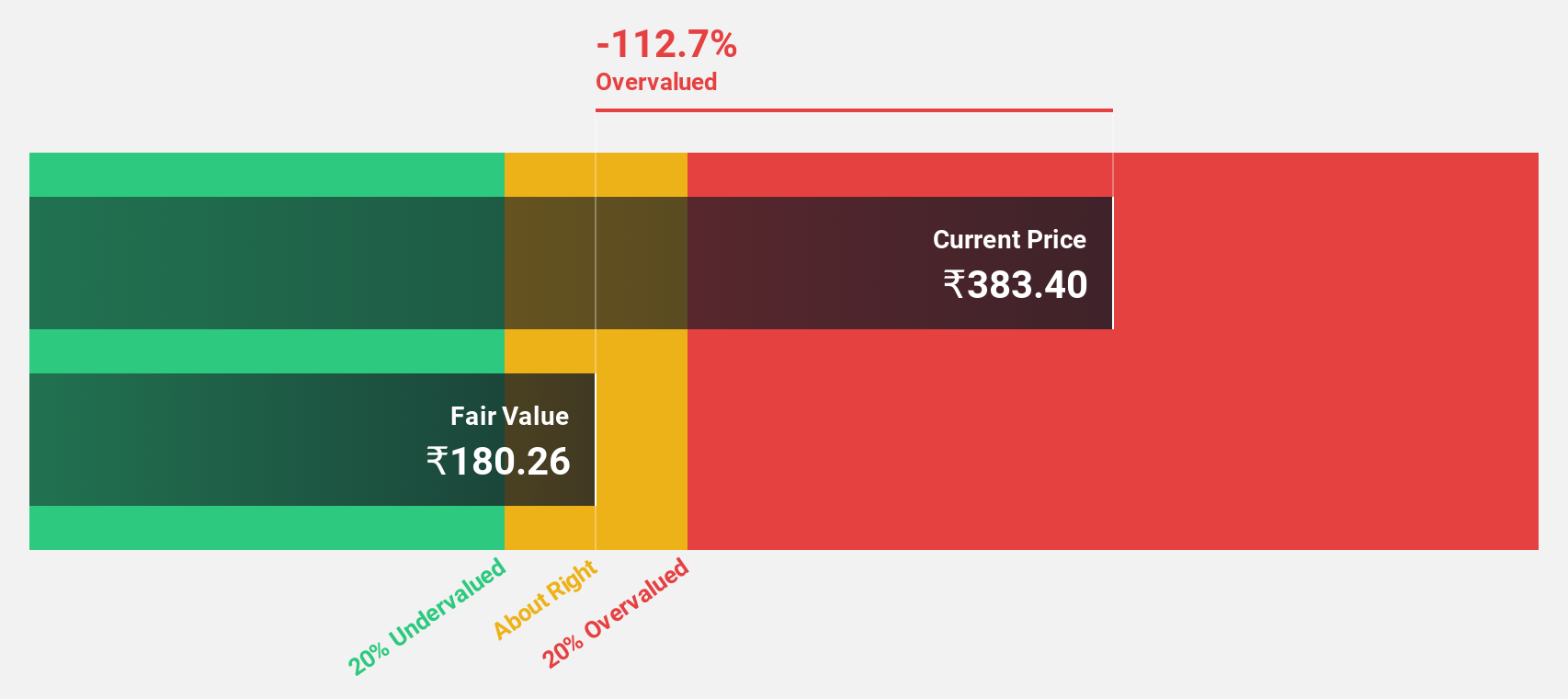

Valuation is complex, but we're here to simplify it.

Discover if Blue Jet Healthcare might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:BLUEJET

Blue Jet Healthcare

Engages in the manufacturing and sale of pharmaceutical intermediates and active pharmaceutical ingredients (APIs) for use in pharmaceutical and healthcare products.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives