Further Upside For Solara Active Pharma Sciences Limited (NSE:SOLARA) Shares Could Introduce Price Risks After 25% Bounce

Solara Active Pharma Sciences Limited (NSE:SOLARA) shareholders would be excited to see that the share price has had a great month, posting a 25% gain and recovering from prior weakness. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 3.4% in the last twelve months.

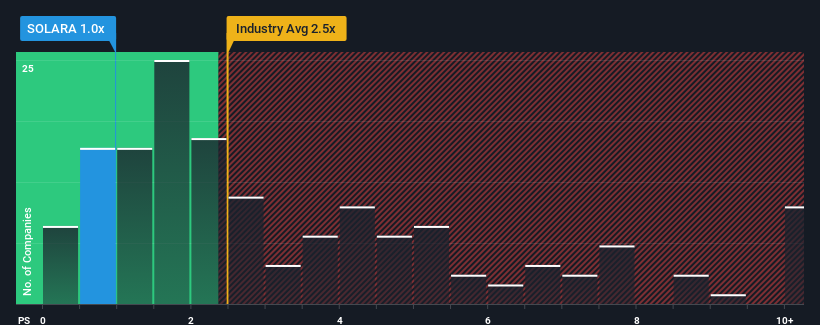

In spite of the firm bounce in price, Solara Active Pharma Sciences' price-to-sales (or "P/S") ratio of 1x might still make it look like a buy right now compared to the Pharmaceuticals industry in India, where around half of the companies have P/S ratios above 2.5x and even P/S above 6x are quite common. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Solara Active Pharma Sciences

What Does Solara Active Pharma Sciences' Recent Performance Look Like?

With revenue growth that's superior to most other companies of late, Solara Active Pharma Sciences has been doing relatively well. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Solara Active Pharma Sciences will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The Low P/S?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Solara Active Pharma Sciences' to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 37% last year. As a result, it also grew revenue by 12% in total over the last three years. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 13% over the next year. Meanwhile, the rest of the industry is forecast to expand by 12%, which is not materially different.

With this in consideration, we find it intriguing that Solara Active Pharma Sciences' P/S is lagging behind its industry peers. It may be that most investors are not convinced the company can achieve future growth expectations.

What We Can Learn From Solara Active Pharma Sciences' P/S?

Solara Active Pharma Sciences' stock price has surged recently, but its but its P/S still remains modest. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've seen that Solara Active Pharma Sciences currently trades on a lower than expected P/S since its forecast growth is in line with the wider industry. The low P/S could be an indication that the revenue growth estimates are being questioned by the market. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

Before you take the next step, you should know about the 2 warning signs for Solara Active Pharma Sciences (1 is a bit unpleasant!) that we have uncovered.

If you're unsure about the strength of Solara Active Pharma Sciences' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:SOLARA

Solara Active Pharma Sciences

Manufactures, produces, processes, formulates, sells, imports, exports, merchandises, distributes, trades in, and deals in active pharmaceutical ingredients (API) in India, Asia Pacific, Europe, North America, South America, and internationally.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives