What Shilpa Medicare Limited's (NSE:SHILPAMED) 28% Share Price Gain Is Not Telling You

Shilpa Medicare Limited (NSE:SHILPAMED) shares have continued their recent momentum with a 28% gain in the last month alone. The last month tops off a massive increase of 142% in the last year.

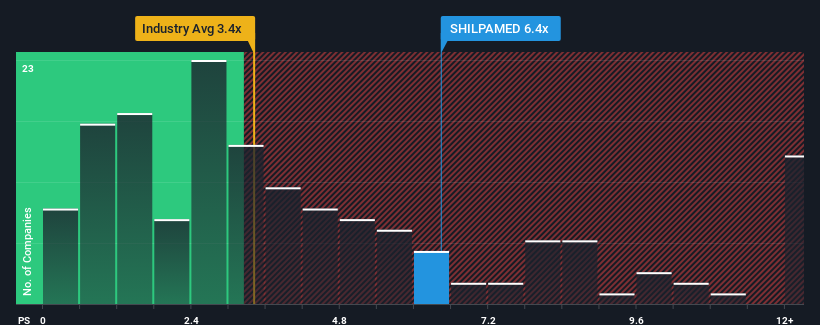

Since its price has surged higher, when almost half of the companies in India's Pharmaceuticals industry have price-to-sales ratios (or "P/S") below 3.4x, you may consider Shilpa Medicare as a stock not worth researching with its 6.4x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

See our latest analysis for Shilpa Medicare

What Does Shilpa Medicare's P/S Mean For Shareholders?

There hasn't been much to differentiate Shilpa Medicare's and the industry's revenue growth lately. One possibility is that the P/S ratio is high because investors think this modest revenue performance will accelerate. If not, then existing shareholders may be a little nervous about the viability of the share price.

Keen to find out how analysts think Shilpa Medicare's future stacks up against the industry? In that case, our free report is a great place to start.Is There Enough Revenue Growth Forecasted For Shilpa Medicare?

The only time you'd be truly comfortable seeing a P/S as steep as Shilpa Medicare's is when the company's growth is on track to outshine the industry decidedly.

If we review the last year of revenue growth, the company posted a worthy increase of 13%. The solid recent performance means it was also able to grow revenue by 29% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Shifting to the future, estimates from the only analyst covering the company suggest revenue should grow by 9.3% over the next year. That's shaping up to be materially lower than the 13% growth forecast for the broader industry.

With this information, we find it concerning that Shilpa Medicare is trading at a P/S higher than the industry. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

The Bottom Line On Shilpa Medicare's P/S

Shares in Shilpa Medicare have seen a strong upwards swing lately, which has really helped boost its P/S figure. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

It comes as a surprise to see Shilpa Medicare trade at such a high P/S given the revenue forecasts look less than stellar. The weakness in the company's revenue estimate doesn't bode well for the elevated P/S, which could take a fall if the revenue sentiment doesn't improve. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Shilpa Medicare (at least 2 which can't be ignored), and understanding these should be part of your investment process.

If these risks are making you reconsider your opinion on Shilpa Medicare, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:SHILPAMED

Shilpa Medicare

Manufactures and sells active pharmaceutical ingredients (APIs), finished dosage formulations, biosimilars, recombinant albumin in India, the United States, Europe, and internationally.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives