Shilpa Medicare's (NSE:SHILPAMED) earnings growth rate lags the 30% CAGR delivered to shareholders

While Shilpa Medicare Limited (NSE:SHILPAMED) shareholders are probably generally happy, the stock hasn't had particularly good run recently, with the share price falling 22% in the last quarter. In contrast, the return over three years has been impressive. Indeed, the share price is up a very strong 120% in that time. It's not uncommon to see a share price retrace a bit, after a big gain. The thing to consider is whether the underlying business is doing well enough to support the current price.

Although Shilpa Medicare has shed ₹4.9b from its market cap this week, let's take a look at its longer term fundamental trends and see if they've driven returns.

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

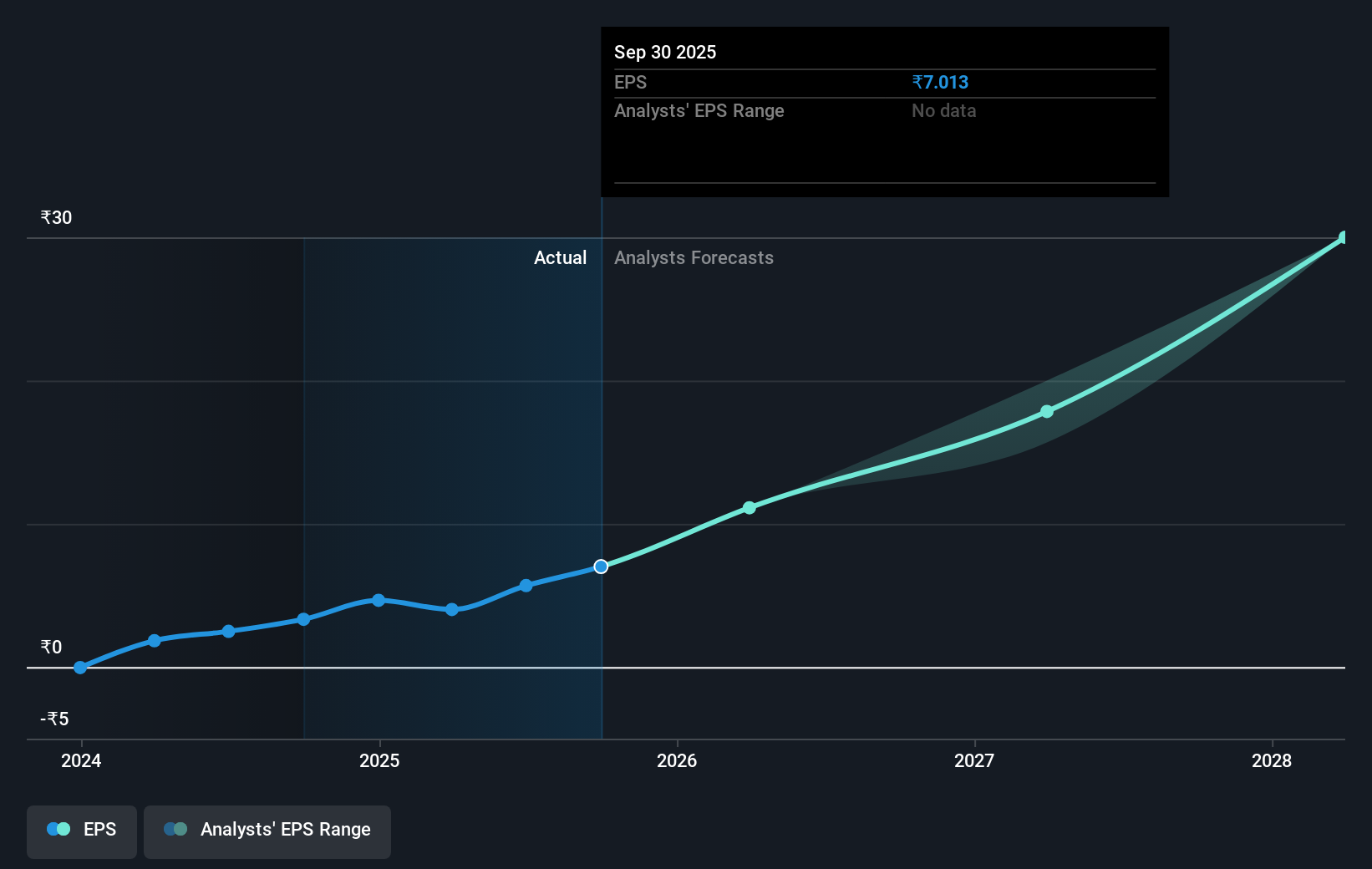

During three years of share price growth, Shilpa Medicare achieved compound earnings per share growth of 78% per year. The average annual share price increase of 30% is actually lower than the EPS growth. So it seems investors have become more cautious about the company, over time.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

It is of course excellent to see how Shilpa Medicare has grown profits over the years, but the future is more important for shareholders. This free interactive report on Shilpa Medicare's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

Shilpa Medicare shareholders are down 22% for the year (even including dividends), but the market itself is up 0.1%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Longer term investors wouldn't be so upset, since they would have made 6%, each year, over five years. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. If you would like to research Shilpa Medicare in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

But note: Shilpa Medicare may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Indian exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:SHILPAMED

Shilpa Medicare

Manufactures and sells active pharmaceutical ingredients (APIs), finished dosage formulations, biosimilars, and contract development and manufacturing organisation in India, the United States, Europe, and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PRME remains a long shot but publication in the New England Journal of Medicine helps.

This one is all about the tax benefits

Estimated Share Price is $79.54 using the Buffett Value Calculation

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026