There's No Escaping Panacea Biotec Limited's (NSE:PANACEABIO) Muted Revenues Despite A 34% Share Price Rise

Despite an already strong run, Panacea Biotec Limited (NSE:PANACEABIO) shares have been powering on, with a gain of 34% in the last thirty days. The last month tops off a massive increase of 165% in the last year.

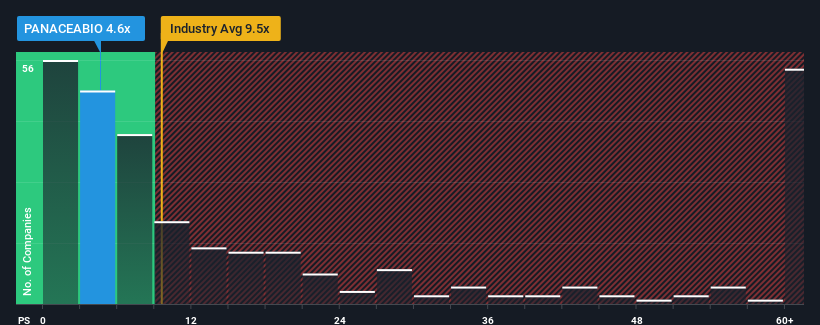

Even after such a large jump in price, Panacea Biotec may still be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 4.6x, since almost half of all companies in the Biotechs industry in India have P/S ratios greater than 6.6x and even P/S higher than 13x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for Panacea Biotec

What Does Panacea Biotec's P/S Mean For Shareholders?

The recent revenue growth at Panacea Biotec would have to be considered satisfactory if not spectacular. Perhaps the market believes the recent revenue performance might fall short of industry figures in the near future, leading to a reduced P/S. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Although there are no analyst estimates available for Panacea Biotec, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Do Revenue Forecasts Match The Low P/S Ratio?

Panacea Biotec's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Retrospectively, the last year delivered a decent 6.5% gain to the company's revenues. Ultimately though, it couldn't turn around the poor performance of the prior period, with revenue shrinking 18% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Comparing that to the industry, which is predicted to deliver 64% growth in the next 12 months, the company's downward momentum based on recent medium-term revenue results is a sobering picture.

With this in mind, we understand why Panacea Biotec's P/S is lower than most of its industry peers. However, we think shrinking revenues are unlikely to lead to a stable P/S over the longer term, which could set up shareholders for future disappointment. Even just maintaining these prices could be difficult to achieve as recent revenue trends are already weighing down the shares.

The Final Word

Panacea Biotec's stock price has surged recently, but its but its P/S still remains modest. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our examination of Panacea Biotec confirms that the company's shrinking revenue over the past medium-term is a key factor in its low price-to-sales ratio, given the industry is projected to grow. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises either. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Panacea Biotec (at least 1 which is a bit unpleasant), and understanding these should be part of your investment process.

If these risks are making you reconsider your opinion on Panacea Biotec, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:PANACEABIO

Panacea Biotec

A biotechnology company, engages in the research, development, manufacture, and marketing of vaccines, pharmaceutical formulations, nutraceuticals, and food and nutrition products in India and internationally.

Adequate balance sheet with questionable track record.

Similar Companies

Market Insights

Community Narratives