There's Reason For Concern Over Neuland Laboratories Limited's (NSE:NEULANDLAB) Massive 25% Price Jump

The Neuland Laboratories Limited (NSE:NEULANDLAB) share price has done very well over the last month, posting an excellent gain of 25%. The last month tops off a massive increase of 273% in the last year.

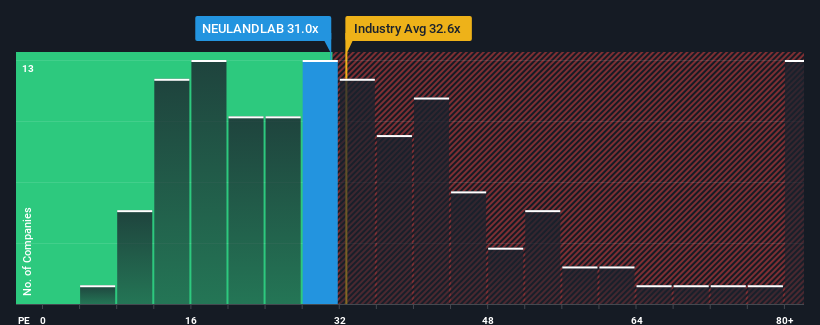

Although its price has surged higher, there still wouldn't be many who think Neuland Laboratories' price-to-earnings (or "P/E") ratio of 31x is worth a mention when the median P/E in India is similar at about 31x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Neuland Laboratories certainly has been doing a good job lately as it's been growing earnings more than most other companies. One possibility is that the P/E is moderate because investors think this strong earnings performance might be about to tail off. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Check out our latest analysis for Neuland Laboratories

Is There Some Growth For Neuland Laboratories?

The only time you'd be comfortable seeing a P/E like Neuland Laboratories' is when the company's growth is tracking the market closely.

Retrospectively, the last year delivered an exceptional 215% gain to the company's bottom line. Pleasingly, EPS has also lifted 487% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing earnings over that time.

Turning to the outlook, the next year should bring diminished returns, with earnings decreasing 0.6% as estimated by the two analysts watching the company. Meanwhile, the broader market is forecast to expand by 24%, which paints a poor picture.

In light of this, it's somewhat alarming that Neuland Laboratories' P/E sits in line with the majority of other companies. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock right now. Only the boldest would assume these prices are sustainable as these declining earnings are likely to weigh on the share price eventually.

The Bottom Line On Neuland Laboratories' P/E

Neuland Laboratories appears to be back in favour with a solid price jump getting its P/E back in line with most other companies. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Neuland Laboratories currently trades on a higher than expected P/E for a company whose earnings are forecast to decline. When we see a poor outlook with earnings heading backwards, we suspect share price is at risk of declining, sending the moderate P/E lower. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

A lot of potential risks can sit within a company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Neuland Laboratories with six simple checks.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Neuland Laboratories might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:NEULANDLAB

Neuland Laboratories

Manufactures and sells active pharmaceutical ingredients (APIs) in India, Europe, the United States, and internationally.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives