Subdued Growth No Barrier To Neuland Laboratories Limited (NSE:NEULANDLAB) With Shares Advancing 29%

Neuland Laboratories Limited (NSE:NEULANDLAB) shareholders have had their patience rewarded with a 29% share price jump in the last month. The last 30 days were the cherry on top of the stock's 342% gain in the last year, which is nothing short of spectacular.

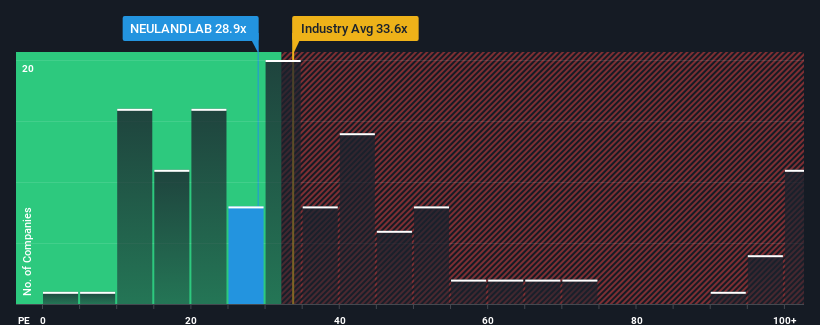

Even after such a large jump in price, you could still be forgiven for feeling indifferent about Neuland Laboratories' P/E ratio of 28.9x, since the median price-to-earnings (or "P/E") ratio in India is also close to 31x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

With earnings growth that's superior to most other companies of late, Neuland Laboratories has been doing relatively well. One possibility is that the P/E is moderate because investors think this strong earnings performance might be about to tail off. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

See our latest analysis for Neuland Laboratories

Is There Some Growth For Neuland Laboratories?

The only time you'd be comfortable seeing a P/E like Neuland Laboratories' is when the company's growth is tracking the market closely.

If we review the last year of earnings growth, the company posted a terrific increase of 215%. Pleasingly, EPS has also lifted 487% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Turning to the outlook, the next year should bring diminished returns, with earnings decreasing 0.6% as estimated by the lone analyst watching the company. Meanwhile, the broader market is forecast to expand by 25%, which paints a poor picture.

In light of this, it's somewhat alarming that Neuland Laboratories' P/E sits in line with the majority of other companies. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock right now. There's a good chance these shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the negative growth outlook.

What We Can Learn From Neuland Laboratories' P/E?

Its shares have lifted substantially and now Neuland Laboratories' P/E is also back up to the market median. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Neuland Laboratories' analyst forecasts revealed that its outlook for shrinking earnings isn't impacting its P/E as much as we would have predicted. When we see a poor outlook with earnings heading backwards, we suspect share price is at risk of declining, sending the moderate P/E lower. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

Many other vital risk factors can be found on the company's balance sheet. Our free balance sheet analysis for Neuland Laboratories with six simple checks will allow you to discover any risks that could be an issue.

If these risks are making you reconsider your opinion on Neuland Laboratories, explore our interactive list of high quality stocks to get an idea of what else is out there.

If you're looking to trade Neuland Laboratories, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Neuland Laboratories might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:NEULANDLAB

Neuland Laboratories

Manufactures and sells active pharmaceutical ingredients (APIs) in India, Europe, the United States, and internationally.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives