The one-year underlying earnings growth at Nectar Lifesciences (NSE:NECLIFE) is promising, but the shareholders are still in the red over that time

Passive investing in an index fund is a good way to ensure your own returns roughly match the overall market. But if you buy individual stocks, you can do both better or worse than that. That downside risk was realized by Nectar Lifesciences Limited (NSE:NECLIFE) shareholders over the last year, as the share price declined 37%. That's well below the market decline of 1.0%. At least the damage isn't so bad if you look at the last three years, since the stock is down 9.2% in that time. Furthermore, it's down 16% in about a quarter. That's not much fun for holders.

Since Nectar Lifesciences has shed ₹680m from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Even though the Nectar Lifesciences share price is down over the year, its EPS actually improved. Of course, the situation might betray previous over-optimism about growth.

It's surprising to see the share price fall so much, despite the improved EPS. But we might find some different metrics explain the share price movements better.

Nectar Lifesciences' revenue is actually up 3.0% over the last year. Since the fundamental metrics don't readily explain the share price drop, there might be an opportunity if the market has overreacted.

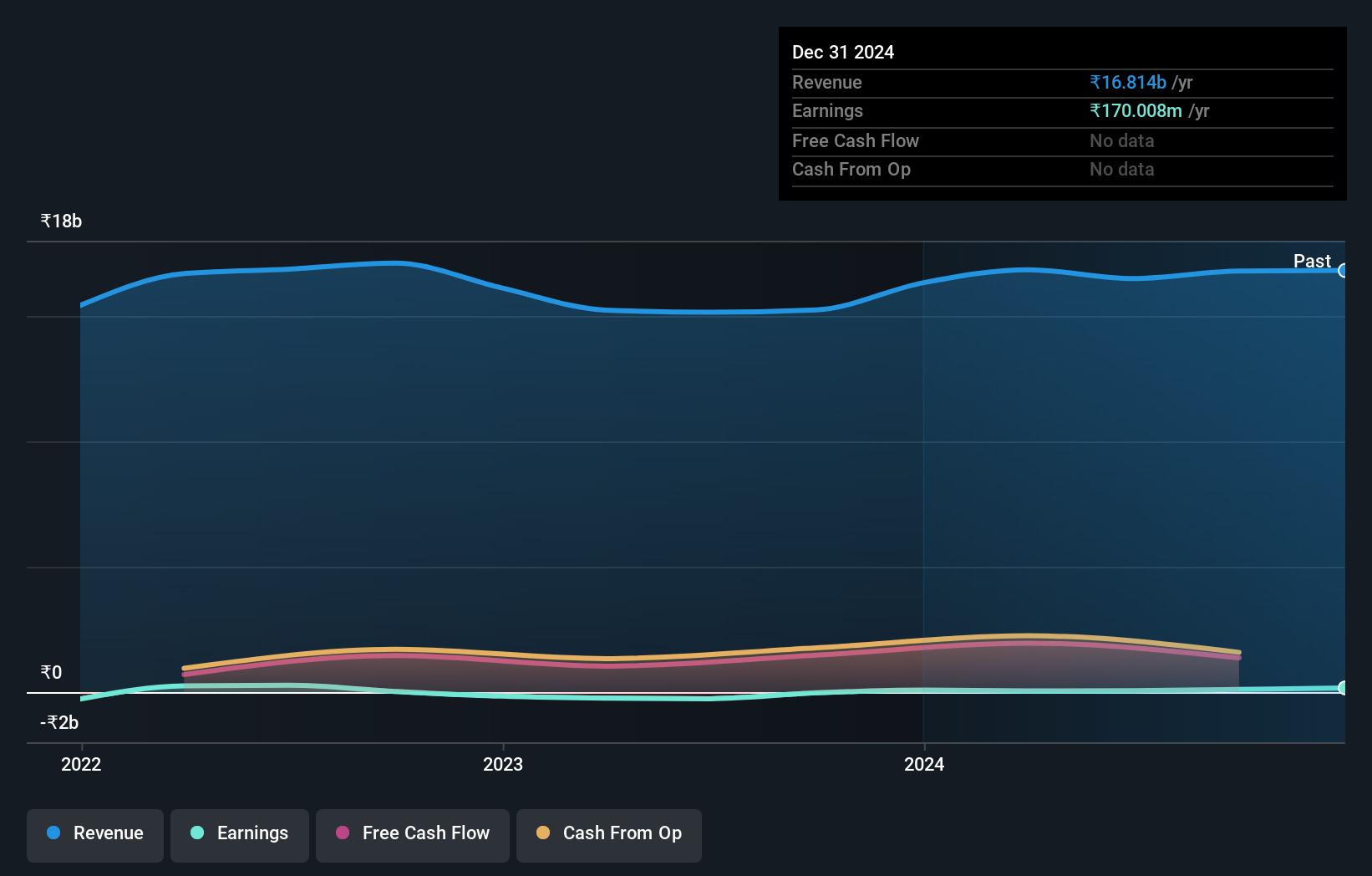

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. Dive deeper into the earnings by checking this interactive graph of Nectar Lifesciences' earnings, revenue and cash flow.

A Different Perspective

Investors in Nectar Lifesciences had a tough year, with a total loss of 37%, against a market gain of about 1.0%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 3% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. It's always interesting to track share price performance over the longer term. But to understand Nectar Lifesciences better, we need to consider many other factors. For example, we've discovered 3 warning signs for Nectar Lifesciences (1 is significant!) that you should be aware of before investing here.

Nectar Lifesciences is not the only stock that insiders are buying. For those who like to find lesser know companies this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Indian exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Nectar Lifesciences might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:NECLIFE

Nectar Lifesciences

Manufactures, distributes, markets and sells pharmaceutical products in India and internationally.

Excellent balance sheet and good value.

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success