NATCO Pharma Limited (NSE:NATCOPHARM) Exceeded Expectations And The Analyst Consensus Has Been Reviewing Its Models

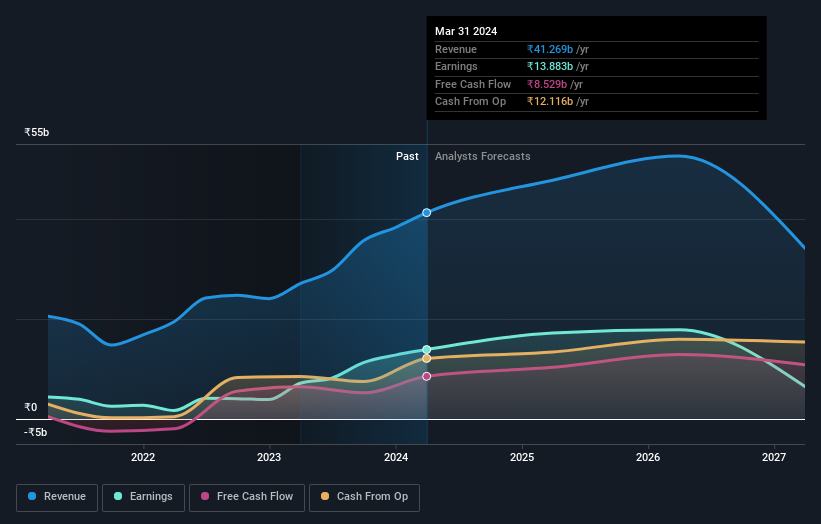

NATCO Pharma Limited (NSE:NATCOPHARM) defied analyst predictions to release its annual results, which were ahead of market expectations. The company beat expectations with revenues of ₹41b arriving 5.3% ahead of forecasts. Statutory earnings per share (EPS) were ₹77.34, 5.6% ahead of estimates. The analysts typically update their forecasts at each earnings report, and we can judge from their estimates whether their view of the company has changed or if there are any new concerns to be aware of. We thought readers would find it interesting to see the analysts latest (statutory) post-earnings forecasts for next year.

View our latest analysis for NATCO Pharma

Following the latest results, NATCO Pharma's eleven analysts are now forecasting revenues of ₹47.8b in 2025. This would be a decent 16% improvement in revenue compared to the last 12 months. Statutory earnings per share are predicted to leap 24% to ₹95.74. In the lead-up to this report, the analysts had been modelling revenues of ₹45.8b and earnings per share (EPS) of ₹86.22 in 2025. There's been a pretty noticeable increase in sentiment, with the analysts upgrading revenues and making a nice increase in earnings per share in particular.

Despite these upgrades,the analysts have not made any major changes to their price target of ₹1,022, suggesting that the higher estimates are not likely to have a long term impact on what the stock is worth. Fixating on a single price target can be unwise though, since the consensus target is effectively the average of analyst price targets. As a result, some investors like to look at the range of estimates to see if there are any diverging opinions on the company's valuation. Currently, the most bullish analyst values NATCO Pharma at ₹1,250 per share, while the most bearish prices it at ₹620. This is a fairly broad spread of estimates, suggesting that analysts are forecasting a wide range of possible outcomes for the business.

One way to get more context on these forecasts is to look at how they compare to both past performance, and how other companies in the same industry are performing. We can infer from the latest estimates that forecasts expect a continuation of NATCO Pharma'shistorical trends, as the 16% annualised revenue growth to the end of 2025 is roughly in line with the 14% annual growth over the past five years. Compare this with the broader industry, which analyst estimates (in aggregate) suggest will see revenues grow 10% annually. So it's pretty clear that NATCO Pharma is forecast to grow substantially faster than its industry.

The Bottom Line

The most important thing here is that the analysts upgraded their earnings per share estimates, suggesting that there has been a clear increase in optimism towards NATCO Pharma following these results. Happily, they also upgraded their revenue estimates, and are forecasting them to grow faster than the wider industry. The consensus price target held steady at ₹1,022, with the latest estimates not enough to have an impact on their price targets.

With that in mind, we wouldn't be too quick to come to a conclusion on NATCO Pharma. Long-term earnings power is much more important than next year's profits. At Simply Wall St, we have a full range of analyst estimates for NATCO Pharma going out to 2027, and you can see them free on our platform here..

Plus, you should also learn about the 2 warning signs we've spotted with NATCO Pharma (including 1 which doesn't sit too well with us) .

Valuation is complex, but we're here to simplify it.

Discover if NATCO Pharma might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:NATCOPHARM

NATCO Pharma

A pharmaceutical company, engages in the developing, manufacturing, and marketing of finished dosage formulations, active pharmaceutical ingredients (APIs), and intermediates in India, the United States, and internationally.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives