Laurus Labs (NSE:LAURUSLABS) Is Paying Out A Dividend Of ₹1.20

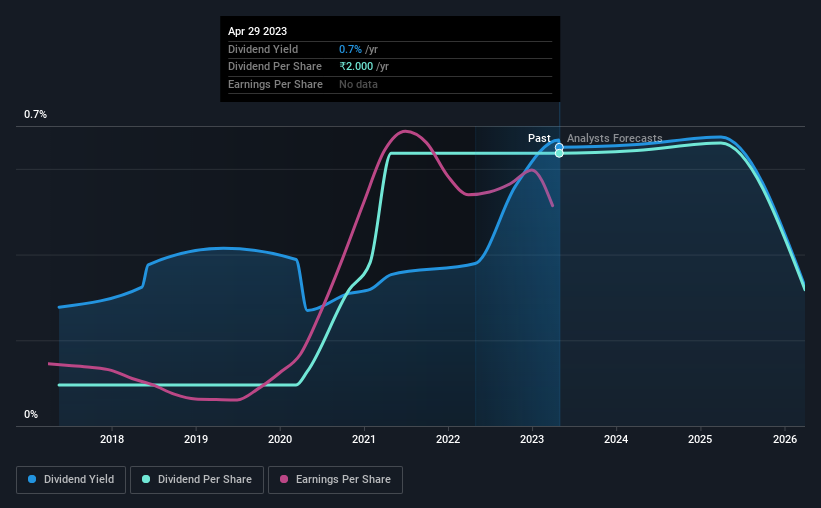

Laurus Labs Limited's (NSE:LAURUSLABS) investors are due to receive a payment of ₹1.20 per share on 27th of May. The dividend yield is 0.7% based on this payment, which is a little bit low compared to the other companies in the industry.

See our latest analysis for Laurus Labs

Laurus Labs' Dividend Is Well Covered By Earnings

The dividend yield is a little bit low, but sustainability of the payments is also an important part of evaluating an income stock. Before making this announcement, Laurus Labs was paying a whopping 2,880% as a dividend, but this only made up 14% of its overall earnings. The business might be trying to strike a balance between returning cash to shareholders and reinvesting back into the business, but this high of a payout ratio could definitely force the dividend to be cut if the company runs into a bit of a tough spot.

Over the next year, EPS is forecast to expand by 47.4%. If the dividend continues on this path, the payout ratio could be 12% by next year, which we think can be pretty sustainable going forward.

Laurus Labs Doesn't Have A Long Payment History

Laurus Labs' dividend has been pretty stable for a little while now, but we will continue to be cautious until it has been demonstrated for a few more years. Since 2017, the dividend has gone from ₹0.30 total annually to ₹2.00. This implies that the company grew its distributions at a yearly rate of about 37% over that duration. We're not overly excited about the relatively short history of dividend payments, however the dividend is growing at a nice rate and we might take a closer look.

The Dividend Looks Likely To Grow

Investors who have held shares in the company for the past few years will be happy with the dividend income they have received. Laurus Labs has impressed us by growing EPS at 36% per year over the past five years. A low payout ratio gives the company a lot of flexibility, and growing earnings also make it very easy for it to grow the dividend.

Our Thoughts On Laurus Labs' Dividend

Overall, it's nice to see a consistent dividend payment, but we think that longer term, the current level of payment might be unsustainable. While the low payout ratio is a redeeming feature, this is offset by the minimal cash to cover the payments. We would probably look elsewhere for an income investment.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. However, there are other things to consider for investors when analysing stock performance. For example, we've picked out 2 warning signs for Laurus Labs that investors should know about before committing capital to this stock. Is Laurus Labs not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:LAURUSLABS

Laurus Labs

Manufactures and sells medicines and active pharmaceutical ingredients (APIs) in India and internationally.

Reasonable growth potential with proven track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion