Should You Be Adding Jagsonpal Pharmaceuticals (NSE:JAGSNPHARM) To Your Watchlist Today?

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

In contrast to all that, I prefer to spend time on companies like Jagsonpal Pharmaceuticals (NSE:JAGSNPHARM), which has not only revenues, but also profits. Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

See our latest analysis for Jagsonpal Pharmaceuticals

How Fast Is Jagsonpal Pharmaceuticals Growing Its Earnings Per Share?

In the last three years Jagsonpal Pharmaceuticals's earnings per share took off like a rocket; fast, and from a low base. So the actual rate of growth doesn't tell us much. As a result, I'll zoom in on growth over the last year, instead. Like a falcon taking flight, Jagsonpal Pharmaceuticals's EPS soared from ₹3.54 to ₹5.16, over the last year. That's a commendable gain of 46%.

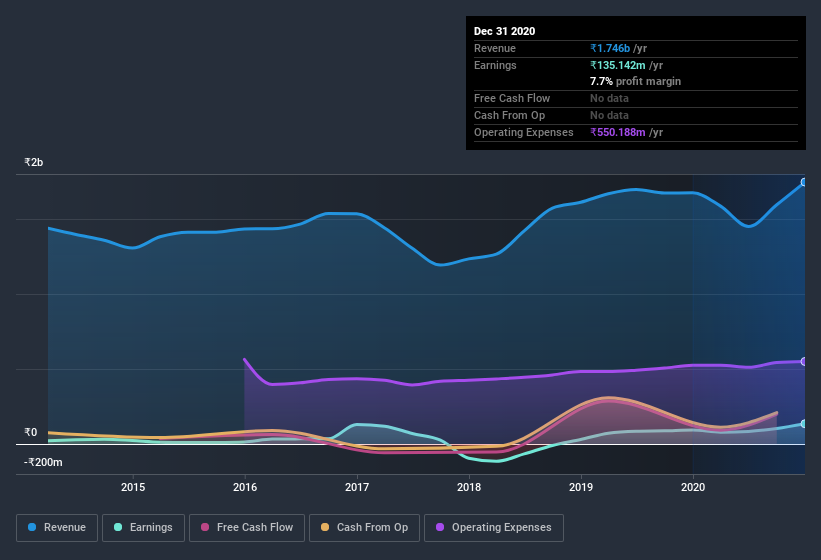

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. The good news is that Jagsonpal Pharmaceuticals is growing revenues, and EBIT margins improved by 2.3 percentage points to 8.0%, over the last year. Ticking those two boxes is a good sign of growth, in my book.

In the chart below, you can see how the company has grown earnings, and revenue, over time. Click on the chart to see the exact numbers.

Jagsonpal Pharmaceuticals isn't a huge company, given its market capitalization of ₹2.0b. That makes it extra important to check on its balance sheet strength.

Are Jagsonpal Pharmaceuticals Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

We note that Jagsonpal Pharmaceuticals insiders spent ₹9.5m on stock, over the last year; in contrast, we didn't see any selling. That's nice to see, because it suggests insiders are optimistic. We also note that it was the Vice President of International Business and International Marketing, Prithipal Kochhar, who made the biggest single acquisition, paying ₹2.0m for shares at about ₹63.94 each.

Should You Add Jagsonpal Pharmaceuticals To Your Watchlist?

You can't deny that Jagsonpal Pharmaceuticals has grown its earnings per share at a very impressive rate. That's attractive. The growth rate whets my appetite for research, and the insider buying only increases my interest in the stock. To put it succinctly; Jagsonpal Pharmaceuticals is a strong candidate for your watchlist. It's still necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Jagsonpal Pharmaceuticals , and understanding these should be part of your investment process.

The good news is that Jagsonpal Pharmaceuticals is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you’re looking to trade Jagsonpal Pharmaceuticals, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:JAGSNPHARM

Jagsonpal Pharmaceuticals

Engages in the manufacturing, selling, and trading of pharmaceutical products and active pharmaceutical ingredients in India and internationally.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives